09.19.2023

Market Insights – 9/19/2023

Wholesale Prices, Week Ending September 16th

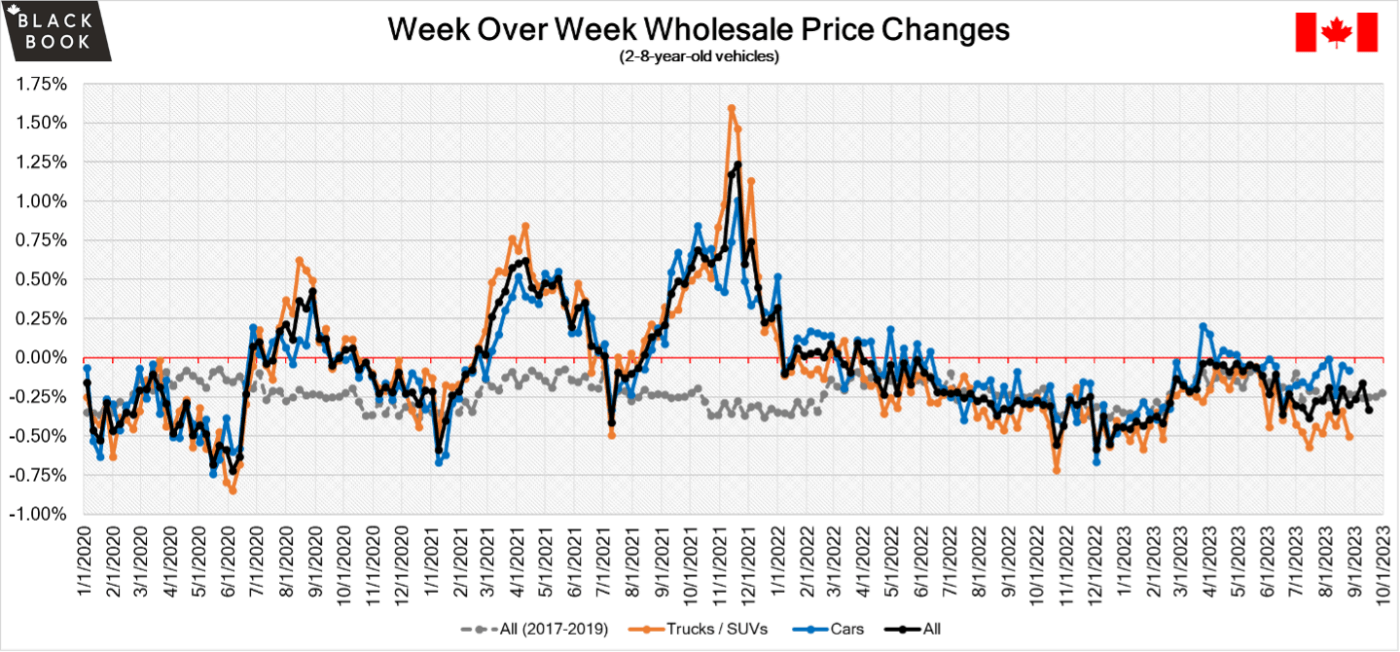

The Canadian used wholesale market saw a decline in prices for the week at -0.33%. The Car segment fell by -0.18% and the Truck/SUVs’ segment prices declined -0.47%. 4 out of 22 segments’ values have increased for the week. The Full-Size Car segment was up 0.15% followed by the Luxury Car segment at +0.09%. The segments with the largest declines were Compact Van at –1.95% followed by Full-Size Van at –1.21%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.18% | -0.06% | -0.25% |

| Truck & SUV segments | -0.47% | -0.26% | -0.26% |

| Market | -0.33% | -0.16% | -0.25% |

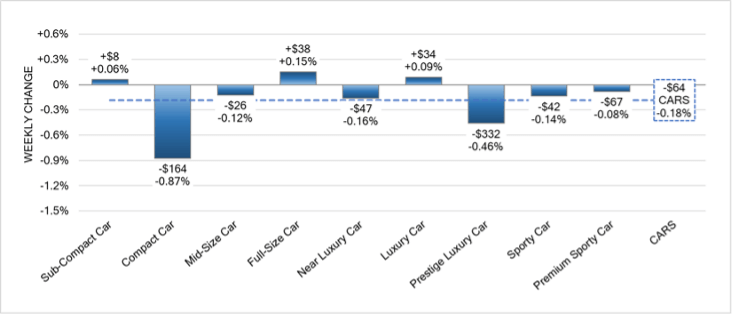

Car Segments

- Last week the Car Segments showed an overall decrease of -0.18%.

- Six of the nine segments showed a drop in pricing. The segments with the largest decline were Compact Car (-0.87%) followed by Prestige Luxury Car (-0.46%) and Near Luxury Car at (-0.16%)

- The two segments with the highest increases were Full-Size Car (+0.15%) and Luxury Car with (+0.09%).

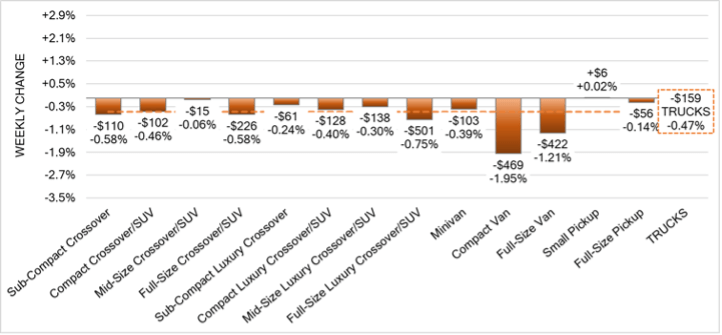

Truck Segments

- Truck segments showed an overall decrease of -0.47% last week.

- All except one of the thirteen truck segments showed a decline. Compact Van had the largest drop (-1.95%), followed by Full-Size Van (-1.21%) and Full-Size Luxury Crossover/SUV (-0.75%).

- There was one segment with a slight increase in value. That segment was Small Pickup (+0.02%).

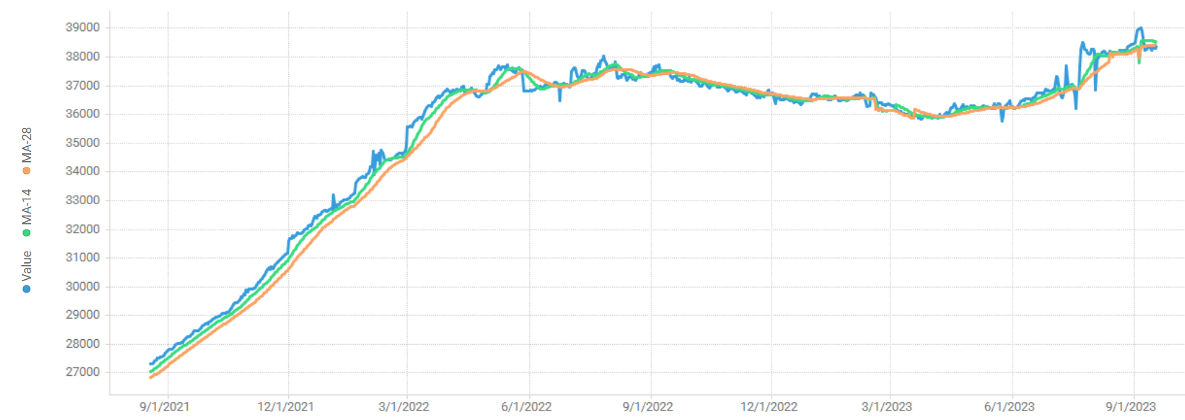

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,400. Analysis is based on approximately 185,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was slightly larger than the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 25% but most were in the 35-45% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Manufacturing sales increased 1.6% month-over-month in July 2023, compared to the preliminary estimate of a 0.7% gain and rebounding from an upwardly revised 2% decline in the previous month.

- Housing starts in Canada fell by 1% over a month earlier to 252,787 units in August 2023, above market expectations of 247,100 units, according to the Canada Mortgage and Housing Corporation.

- Industrial producer prices in Canada jumped by 1.3% over the previous month in August of 2023, the first rise since October of 2022.

- The Canadian dollar is around $0.734 this Monday morning up from $0.741 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.73% last week; the prior week decreased by -0.75%.

Volume-weighted Car segments decreased -0.59%, compared to the prior week’s -0.89% decrease:

- The 0-to-2-year-old Car segments were down -0.31% and 8-to-16-year-old Cars declined -0.67%.

- All nine of the Car segments decreased last week.

- Full-Size Car had the largest decline last week, down -0.99%. The segment has an average weekly decline of -1.24% per week, over the last six weeks.

- Premium Sporty Car went back negative last week, down -0.29%, after three consecutive weeks of increases.

- With fuel prices on the rise, Compact Car had a dramatic slowing in depreciation last week, declining -0.50%, compared with the prior six weeks of declines exceeding 1% (with half of those weeks reporting declines exceeding 2%).

- Sub-Compact Car reported a similar slowing, down -0.39%, after six weeks of large declines.

Volume-weighted Truck segments decreased by -0.79%; the previous week decreased -0.69%:

- The 0-to-2-year-old models declined -0.53% last week, while the 8-to-16-year-olds declined -0.84%.

- All thirteen Truck segments declined last week, with only two of the thirteen reporting declines exceeding 1%.

- The Sub-Compact Luxury Crossover segment had the largest decline last week, down -1.26%. This marks the seventh consecutive week of declines exceeding 1%. The non-luxury Sub-Compact Crossover segment reported a slowing of depreciation, down -0.71% compared with the prior week’s decline of -1.35%.

- Full-Size Trucks increased their depreciation last week, declining -1.20%. In recent weeks, truck incentives have increased, but with the strike now officially underway, this is likely not a new trend for this segment.

Industry News

- BMO’s retail automotive finance arm is shutting down to focus on where its “competitive positioning is strongest”. The move will result in layoffs, but the bank has not confirmed how many workers will be affected.

- The UAW announced strike action last week, as the union and big 3 automakers did not come to an agreement late Thursday night. This is the first time in history that all 3 automakers have undergone a strike at the same time. Roughly 13,000 UAW members went on strike, with a gradual ramp up of closures starting with 3 plants; the Jeep Wrangler/Gladiator, Ford Bronco, and Chevrolet Colorado facilities are the first affected for each manufacturer.

- While lobbying to tone down the Federal EV mandate, the Canadian Automobile Dealers Association (CADA) discussed a possibility to make a change, siting that, “It’s not good for the government’s mandate and it’s not good for dealers to push the targets so far and so fast that consumers can’t adapt”. Even though this proved unsuccessful, the Government was receptive to making things more flexible – a first between these parties.

- Ford Motor Co., American Honda Motor Co, and BMW have announced equal ownership in forming a new company called ChargeScape, that is aimed at creating a single platform to connect electric utilities, automakers and EV consumers to manage energy usage across North America.

- Finalists for the North American Car & Truck of the Year award have been announced. Three finalists in each category will be named in Los Angeles on Nov. 16, with car, truck and utility winners announced in Detroit on Jan. 4, 2024.