09.03.2025

Market Insights – 9/2/25

Wholesale Prices, Week Ending August 30th, 2025

The Canadian used wholesale market saw a decline of -0.16% in pricing for the week. Car segments prices decreased by –0.14% while the Truck/SUV segments decreased by -0.18%. This Weeks top positive segments have been Full-size Crossover/SUV at +0.08% followed by Mid-Size Luxury Crossover/SUV at +0.03%. The largest declines in the Car segments were seen in Full-Size Car at -0.69% and Prestige Luxury Car with -0.37%. The largest declines in the Truck/SUV segments were Full-Size Van at -0.86% followed by Sub-Compact Luxury Crossover/SUV with -0.63%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.14% | -0.30% | -0.24% |

| Truck & SUV segments | -0.18% | -0.37% | -0.24% |

| Market | -0.16% | -0.34% | -0.24% |

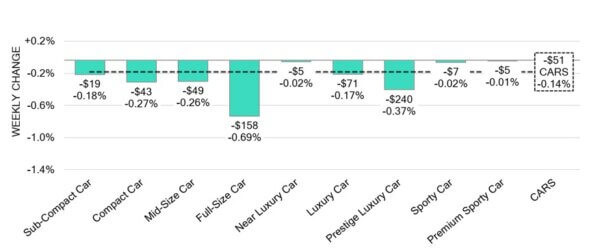

Car Segments

- An overall depreciation of -0.14% was noted in car segments last week. All nine categories reflected this movement.

- Segments with the greatest declines were Full-Size Car (-0.69%), Prestige Luxury Car (-0.37%), Compact Car (-0.27%) and Mid-Size Car (-0.26%).

- Those with the smallest declines were Premium Sporty Car (-0.01%), Near Luxury Car and Sporty Car (-0.02%).

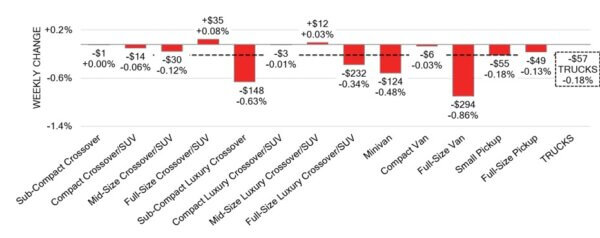

Truck / SUV Segments

- Last week truck segments revealed an overall softening of-0.57%. Ten of the thirteen categories reflected this change.

- Segments with the largest declines were Full-Size Van (-0.86%), Sub-Compact Luxury Crossover(-0.63%), Minivan (-0.48%) and Full-Size Luxury Crossover/SUV (-0.34%).

- Two segments displayed an opposite shift with a slight bump in values. Those were Full-Size Crossover/SUV (+0.08%) and Mid-Size Luxury Crossover/SUV (+0.03%).

Wholesale

The Canadian market remains on a downward trend; with a decline less pronounced compared to previous weeks. The car segments experienced a 0.16% change, resulting in a –0.14% decline. Similarly, truck segment values experienced 0.19% change bringing the total decline to –0.18%. Slightly more than 27% of market segments recorded an average value change exceeding ±$100. The week’s monitored auction sale rates ranged from 21.2% to 53.6%, averaging 33.4%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including, economic uneasiness, political variants and sellers holding strong on floor prices. Even with supply remaining stable, upstream channels continue to gain early access to frontline ready vehicles. There remains a continued demand for inventory and high-quality vehicles at auctions on both sides of the border.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,600. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s GDP contracted by 0.4% in the second quarter of 2025, reversing the

0.5% growth recorded in the previous quarter. - Average weekly earnings in Canada increased by 3.7% year-over-year to CAD

1,302.11 in June 2025, up from a 3.3% rise in May. - Canada’s government recorded a budgetary surplus of $3.63 billion in June 2025,

up from $939 million in the same month last year. - Labor productivity in Canadian businesses declined by 1.0% in Q2 2025,

following a revised 0.1% drop in Q1 and falling short of expectations for 0.2%

growth. - The yield on the Canadian 10-year government bond decreased to 3.35%.

- The Canadian dollar is around $0.725 this Monday morning, up slightly from

$0.723 a week prior.

U.S. Market

- Ahead of the Labor Day holiday, the market remained strong, with overall values showing only a slight decline of -0.10%. Pickups, both Full-Size and Small, continued their upward trend for the second consecutive week, while Mid-Size Cars also joined the limited number of segments posting week-over-week gains.

Industry News

- Canada’s economy retracted in Q2 with a 1.6% decline in GDP as U.S. tariffs and trade uncertainty diminish Canadian exports. But economists are not yet worried that a recession is looming, as it is forecasted, we receive minimal growth in Q3.

- ChargePoint is developing its next generation of EV chargers by increasing its DC fast charging architecture to 600kW for passenger vehicles and up to3750kW for heavy-duty commercial trucks. This increased performance prepares for future upgrades to electric vehicles, as most EVs can’t accept more than 350kW today.

- Kia Canada has partnered with Variable grid Adaptive Power Inc. to bring an alternative to EV customers that no longer requires them to undergo the costly electric panel upgrade by using an adaptive load management approach. It automatically adjusts power to the charger based on available capacity rather than feeding the full amount 24/7.

- Polestar 3 has broken a Guiness record for EV range on a single charge. The stock single-motor long range electric crossover drove 935km on public roads in the U.K. taking a total of 22 hours 57 minutes to accomplish.

- BMW Canada is planning to face tariffs on its models imported from the U.S. Plans to unfreeze inventory of its best-selling X3 and X5 crossovers along with some other models will begin and the brand plans to spread the price impact across the full lineup.

- StatsCan has reported that commuting has increased for the 4th consecutive year, as hybrid work employees are slowly being asked to return to the office.