09.24.2024

Market Insights – 9/24/2024

Wholesale Prices, Week Ending September 21st, 2024

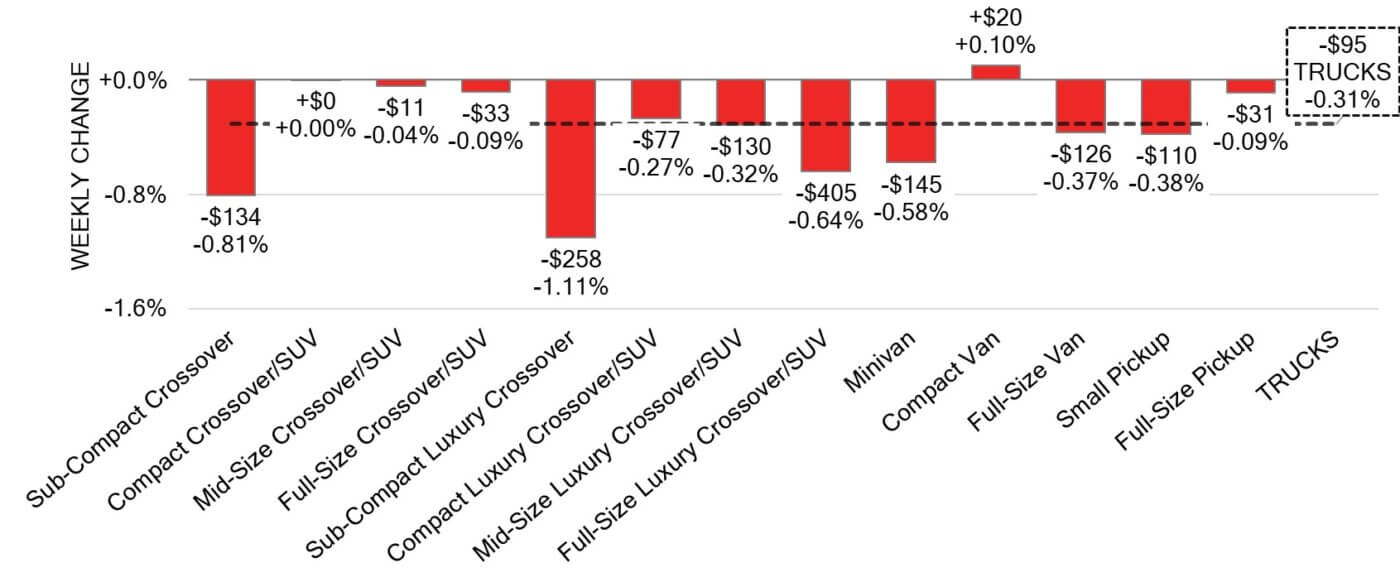

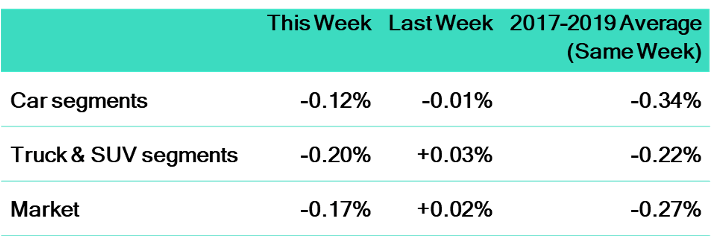

The Canadian used wholesale market experienced a decline of –0.34% in pricing for the week. Car segments prices decreased by –0.37% while the Truck/SUVs segments dropped -0.31%. Compact Van was the only segment with price increase of +0.10%. The largest declines in the car segments were seen in Full Size Car with –0.97% followed by Luxury Car at –0.54%. The largest declines in the Truck/SUV segments were Sub-Compact Luxury Crossover/SUV at -1.11% followed by Full- Size Luxury Crossover/SUV -0.64%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.37% | -0.51% | -0.33% |

| Truck & SUV segments | -0.31% | -0.39% | -0.16% |

| Market | -0.34% | -0.45% | -0.25% |

Car Segments

- Last week there was an overall decrease of -0.37% across Car segments. This decrease was noted across all nine segments.

- The Sub-Compact Car (-0.03%), Premium Sporty Car (-0.12%) and Mid-Size Car (-0.28%) segments showed the smallest declines.

- The largest decreases were seen from Full-Size Car (-0.97%), Luxury Car at (-0.54%) and Prestige Luxury Car at (-0.53%).

Truck / SUV Segments

- Truck segments reflected an overall depreciation of –0.31% last week. Declines were seen in twelve of the thirteen segments.

- Sectors with the largest declines were Sub-Compact Luxury Crossover (-1.11%), Sub-Compact Crossover (-0.81%), Full-Size Luxury Crossover/SUV (-0.64%) and Minivan (-0.58%).

- Compact Vans showed a small positive change (+0.10%).

Wholesale

The Canadian market continues a downward trend, with a decline less pronounced than the previous week. Just over 59% of market segments experienced an average value change of more than ±$100, indicating a lower rate than the previous week. Among these, Car segments experienced a decline 14% less that compared to the previous week. Monitored auction sale rates ranged from 10% to 91% averaging at 45.1% The fluctuations in sale rates across various lanes can be attributed several factors including the ongoing decline in floor prices. An increase in supply entering the wholesale market has been noted, despite upstream channels continuing to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

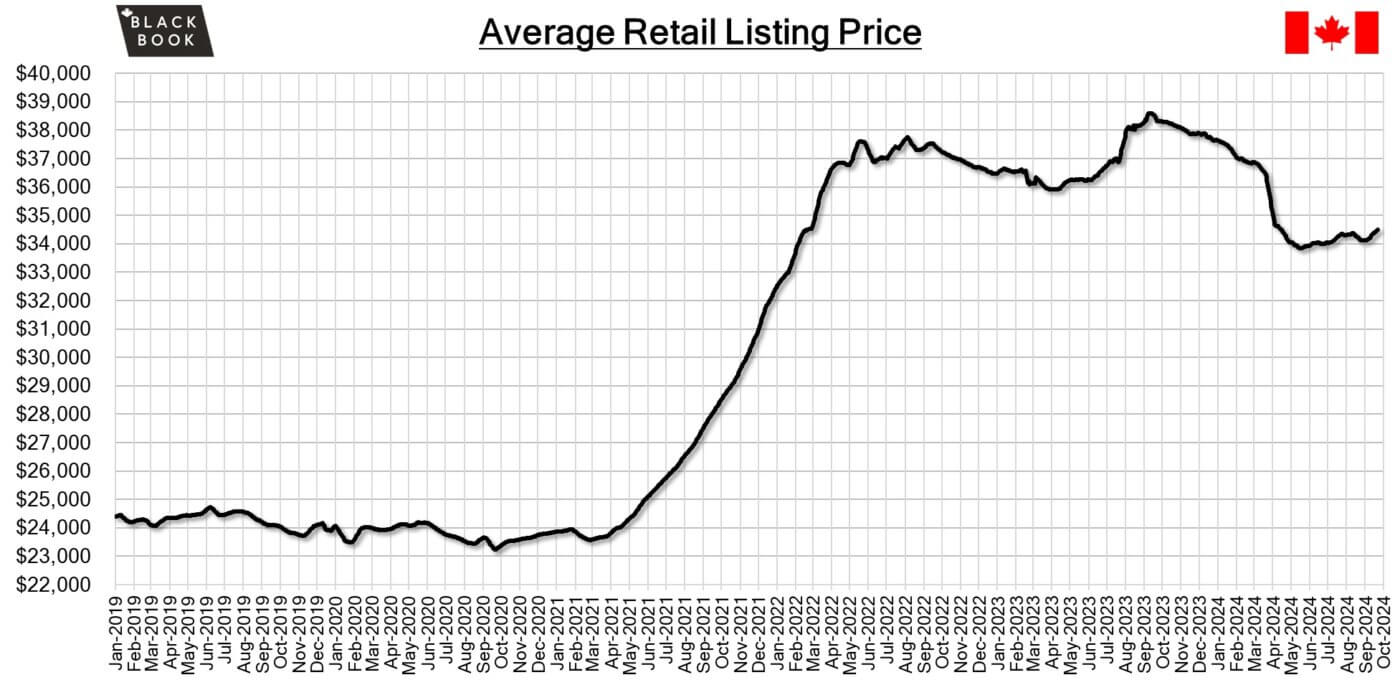

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,400. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In August 2024, retail sales in Canada are expected to have increased by 0.5% compared to the previous month, based on a preliminary estimate.

- In August 2024, Canada saw a significant decline in housing starts, dropping by 22.3% to a total of 217,405 units. This marks the lowest level since November 2023 and falls well short of market expectations, which had projected 252,500 units, according to the Canada Mortgage and Housing Corporation.

- The Raw Materials Price Index in Canada slumped by 3.1% month-over-month in August 2024, following a 0.7% increase in the prior and more than an expected 2.5% fall.

- The yield on the Canadian 10-year government bond decreased slightly to 2.94%.

- The Canadian dollar is around $0.741 this Monday morning, representing a slight increase from $0.735 a week prior.

U.S. Market

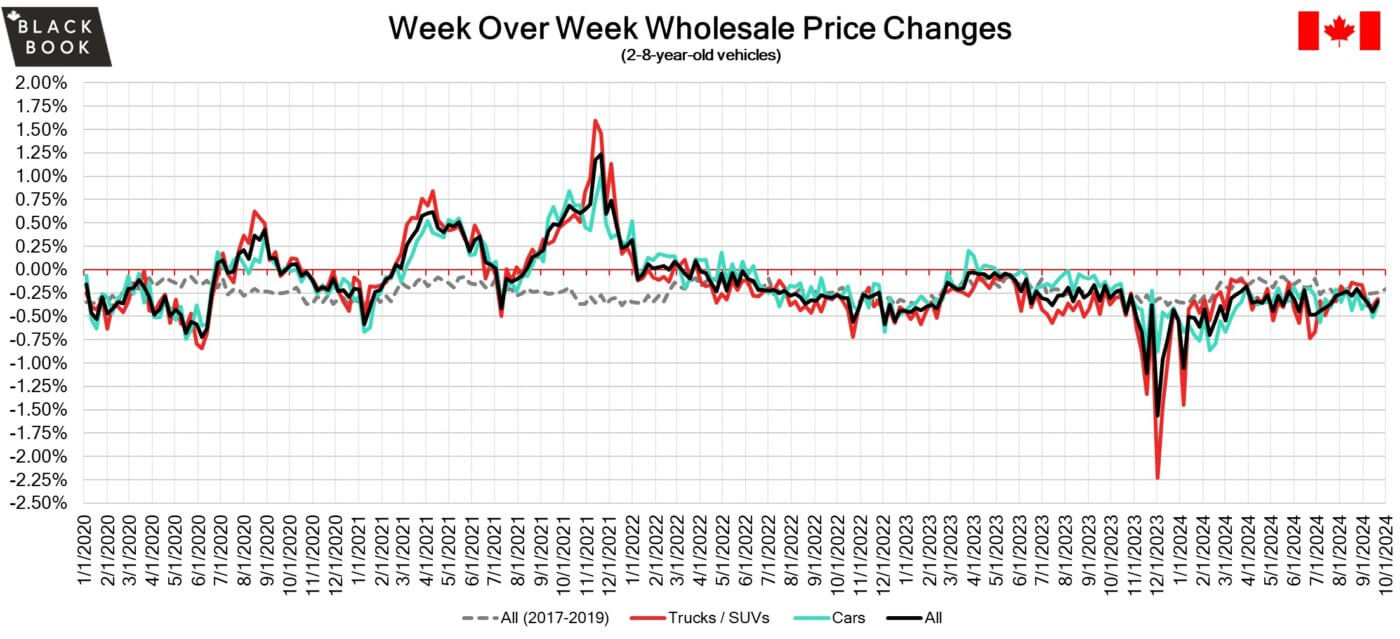

- After four weeks of stability, the market shifted towards typical seasonal expectations with a decline of -0.17%. Despite last week’s drop, the rate of decline remains smaller than usual for this time of year, as pre-COVID, this same week averaged a drop of roughly a quarter percent in valuations.

Industry News

- Many “newcomer” programs managed by the financial arms of Canadian operated car makers as well as the banking sector are supporting the masses of new Canadians arriving to Canada over the last 3 years. The federal government will lean on that support as it forecasts another 1.5 million immigrants to arrive between 2024-2026.

- On September 18th, U.S. owners of GM electric vehicles gained access to Tesla’s Supercharger network, and Canadian owners are soon to follow with the purchase of a $310 adapter.

- A recent North American retailer meeting with Volvo was held on September 17th, where the brand CEO outlined a product roadmap that would see 10 updated and new models over the next 24 months, pivoting away from recent plans for an all-electric lineup with models powered by plug-in and full electric motors that intend to make up 90% of sales by 2030.

- The Dodge Stealth nameplate could be making a return, as Stellantis shared it will be replacing its longstanding Durango SUV with a slightly smaller SUV set to launch in 2027 with production out of the brands’ Windsor, ON plant.

- Volkswagen is issuing a stop-sale for its electric ID.4 crossovers as the model is being recalled over defective door handles that can cause water to leak in and force a circuit board malfunction, opening the door lock while the vehicle is in motion.