09.26.2023

Market Insights – 9/26/2023

Wholesale Prices, Week Ending September 23rd

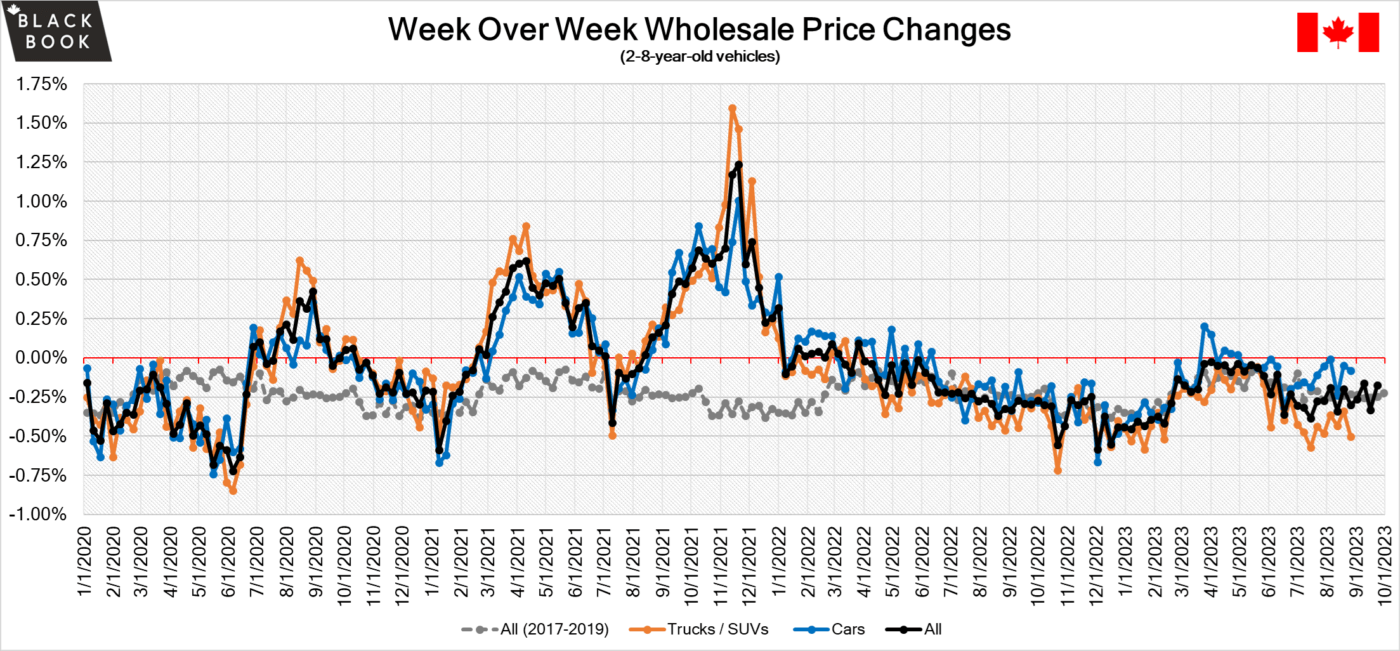

The Canadian used wholesale market saw a decline in prices for the week at -0.17%. The Car segment fell by -0.13% and the Truck/SUVs’ segment prices declined -0.21%. 2 out of 22 segments’ values have increased for the week. The Small Pickup segment was up 0.38% followed by the Subcompact Luxury Crossover segment at +0.03%. The segments with the largest declines were Compact Van at –1.34% followed by Full-Size Car at –0.50%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.13% | -0.18% | -0.33% |

| Truck & SUV segments | -0.21% | -0.47% | -0.16% |

| Market | -0.17% | -0.33% | -0.25% |

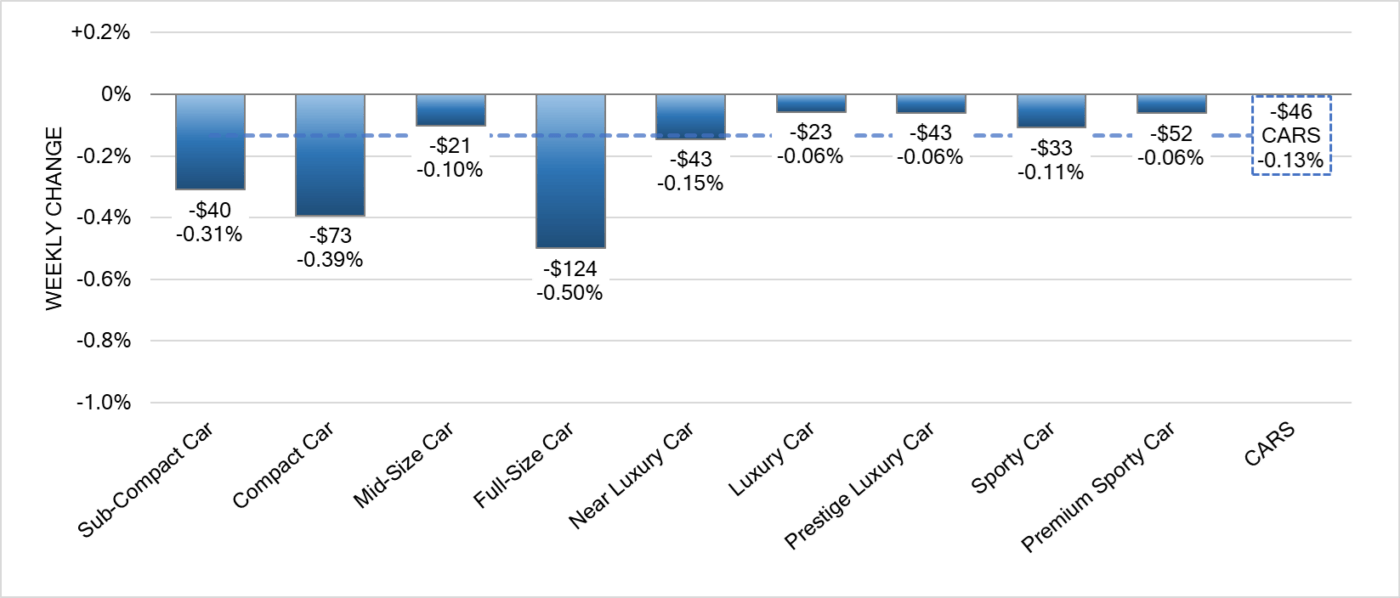

Car Segments

- There was an overall decrease of -0.13% within the Car Segments last week.

- A drop was seen across all nine segments.

- In the lead with the most significant decline was Full-Size Car at (-0.50%) followed by Compact Car (-0.39%) and Sub-Compact Car with (-0.31%).

- All three of the segments Luxury Car, Premium Sporty car & Prestige Luxury Car, showed the least decline with (-0.06%) each.

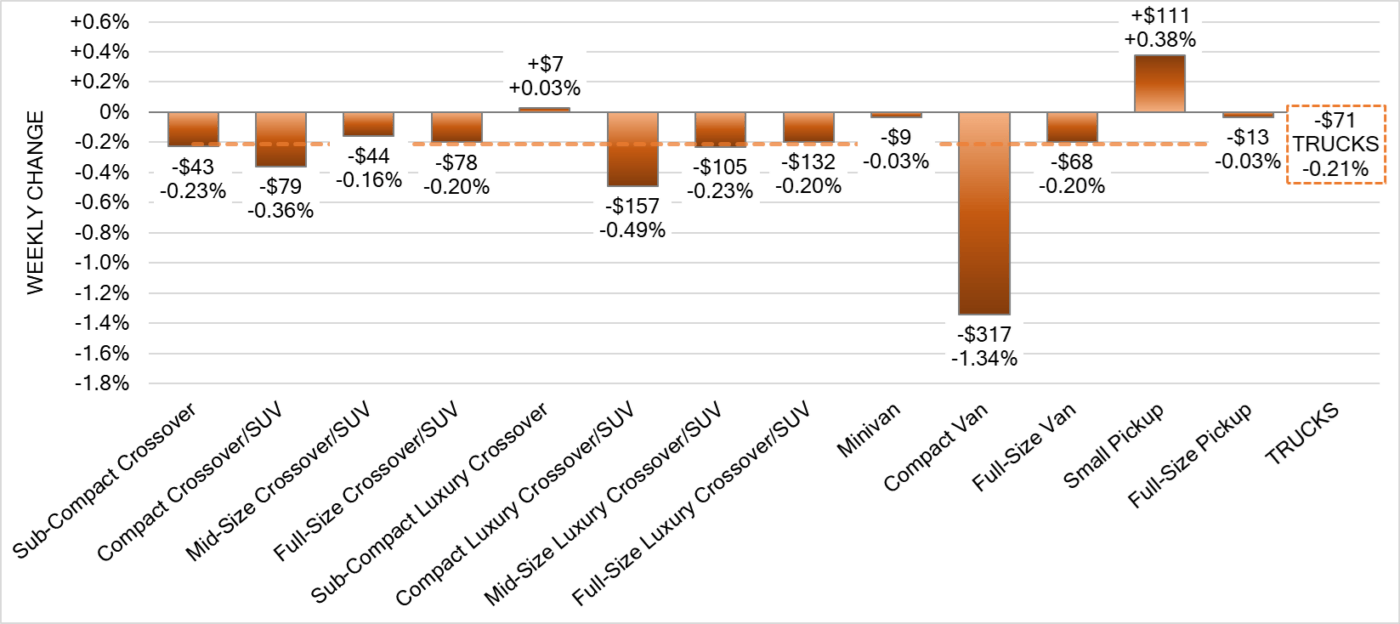

Truck Segments

- Truck segments showed an overall decrease of -0.21% last week.

- Eleven of the thirteen truck segments showed a decline. Compact Van had the largest drop (-1.34%), followed by Compact Luxury Crossover/SUV (-0.49%) and Compact Crossover/SUV (-0.36%).

- Two segments had an increase in value. Those segments were Small Pickup (+0.38%) and Sub-Compact Luxury Crossover (+0.03%).

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,375. Analysis is based on approximately 191,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 12% and as high as 76% but most were in the 25-45% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Inflation in Canada increased to 4% for the month of August compared to 3.3% the prior month.

- Retail sales in Canada are expected to have contracted by 0.3% from the previous month in August of 2023, according to a preliminary estimate.

- Preliminary data showed that manufacturing sales in Canada likely rose by 1 percent from a month earlier in August 2023, following a 1.6 percent gain in July, primarily driven by higher sales in the petroleum & coal product, food, and primary metal subsectors.

- The Canadian dollar is around $0.741 this Monday morning up from $0.734 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.22% last week; the prior week decreased by -0.73%.

Volume-weighted Car segments decreased -0.29%, compared to the prior week’s -0.59% decrease:

- The 0-to-2-year-old Car segments were down -0.13% and 8-to-16-year-old Cars declined -0.28%.

- Seven of the nine Car segments decreased last week.

- Full-Size (+0.14%) and Sporty (+0.03%) Cars increased last week. However, the older model years, 8-to-16-year-olds, continued to decline at a rate of -0.63% and -0.08%, respectively.

- The 0-to-2-year-old Compact Car segment increased for a second consecutive week, up +0.03% last week and +0.09% the week prior.

- Sub-Compact (-0.48%) and Luxury (-0.48%) Car segments had the largest declines last week, but the rate of decline has dramatically slowed down. Sub-Compact Car had the lowest single week depreciation in two months.

Volume-weighted Truck segments decreased by -0.19%; the previous week decreased -0.79%:

- The 0-to-2-year-old models declined -0.12% last week, while the 8-to-16-year-olds declined -0.14%.

- Two of the thirteen Truck segments increased last week, with Mid-Size Crossovers reporting a +0.08% change and Full-Size Crossovers increasing by +0.25%. In contrast, the Luxury equivalents continued to decline.

- Of the 0-to-2-year-old trucks, three of the thirteen segments increased, which included Full-Size Crossover, Minivan, and Small Pickup.

- Of the 8-to-16-year-old Truck segments, five of the thirteen increased.

- Compact Van had the largest decline at -0.79% and marks the twenty-fourth consecutive week of declines.

Industry News

- Unifor has ratified a deal with Ford Canada and its 5,600 union members who voted 54% in favour of a 3-year deal that will provide sizeable wage gains and improved pensions along with Ford investing to expand production in Windsor on one of its powertrain plants starting in 2025.

- The Insurance Institute for Highway Safety has a new moderate front overlap crash test that focuses on 2nd row occupant safety, and all 4 minivans sold in Canada received less than acceptable ratings, sending the automakers back to drawing board to improve in this key area.

- In an effort to acquire more battery production in Canada, Industry Minister Francois-Philippe Champagne has sparked discussion with Toyota and Honda as they seek access of US EV subsidies for upcoming electric vehicles – meaning the possibility for further industry investment in Canada.