10.01.2025

Market Insights – 9/30/25

Wholesale Prices, Week Ending September 27th, 2025

The Canadian used wholesale market saw a decline of -0.26% in pricing for the week. Car segments prices decreased by –0.18% while the Truck/SUV segments decreased by -0.32%. This Weeks positive segment was Sub Compact Car at +0.06%. The largest declines in the Car segments were seen in Full-Size Car at -1.18% and Mid-Size Car with -0.37%. The largest declines in the Truck/SUV segments were Full-size Pickup with -0.81% followed by Mid-Size Luxury Crossover/SUV at -0.65%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.18% | -0.12% | -0.33% |

| Truck & SUV segments | -0.32% | -0.33% | -0.16% |

| Market | -0.26% | -0.24% | -0.25% |

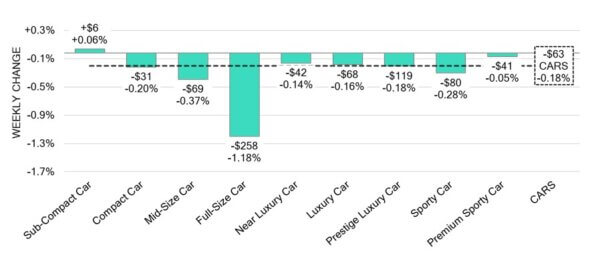

Car Segments

- Car segments experienced an overall depreciation of -0.18%last week. Eight of the nine categories followed this direction.

- Those with the largest drop in values were Full-Size Car (-1.18%), Mid-Size Car (-0.37%), and Sporty Car (-0.28%).

- The smallest declines were noted in Premium Sporty Car (-0.05%), Near Luxury Car (-0.14%) and Luxury Car (-0.16%).

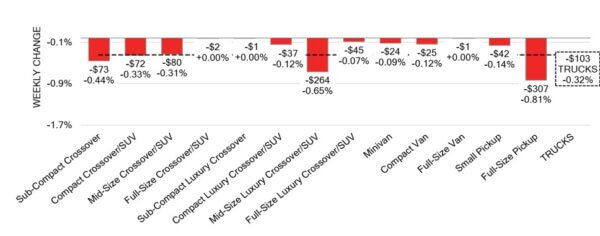

Truck / SUV Segments

- Last week there was an overall decline of -0.32%in truck segments. All thirteen categories followed this direction.

- The largest depreciations were seen in Full-Size Pickup (-0.81%), Mid-Size Luxury Crossover/SUV (-0.65%), Sub-Compact Crossover (-0.44%).

- Three segments had such a nominal softening they showed a 0.00% drop. Those were Full-Size Crossover/SUV, Sub-Compact Luxury Crossover and Full-Size Van.

Wholesale

The Canadian market continues to trend downwards heading into this week. Truck segment values recorded a 0.01% change resulting in a total decline of –0.32%. Car segments also experienced a 0.06% adjustment, bringing its overall decline to –0.18%. Just over 18% of market segments recorded an average value change exceeding ±$100. The week’s monitored auction sale rates ranged from 18.9% to 39%, averaging at 33.3%. Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices. Supply levels remain stable; however, upstream channels are still gaining priority sale access to inventory. Demand for inventory and high-quality vehicles persists at auctions on both sides of the border.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,600. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s manufacturing sales are projected to decline by 1.5% in August 2025,

following a 2.5% gain in July, according to preliminary estimates. - New housing prices in Canada declined by 0.3% month-over-month in August

2025, following a 0.1% decrease in July. This marked the fifth straight monthly

decline and came in below market expectations for no change. - Canada’s Raw Materials Price Index declined by 0.6% month-over-month in

August 2025, reversing a 0.3% increase in July and falling short of the expected

1.2% gain. - Canada’s industrial producer prices increased by 0.5% month-over-month in

August, easing from a 0.7% rise in July and coming in below market expectations

of 0.9%. - The yield on the Canadian 10-year government bond decreased to 3.15%.

- The Canadian dollar is around $0.718 this Monday morning, down slightly from

$0.722 a week prior.

U.S. Market

- Wholesale activity last week underscored the industry’s ‘quality over quantity’ dynamic. Buyers stayed active across most lanes, but their willingness to pay premiums was concentrated on retail-ready units with clean histories, while average condition vehicles drew more cautious bidding. This selectivity reflects a market that is still competitive but increasingly disciplined.

Industry News

- The 9th generation Nissan Sentra will enter the market with greater interior touches that reflect a more premium experience, but the same 2.0 liter, 149hp 4-cylinder engine from the outgoing model remains. An electrified option is being considered by the brand for future model years.

- The Quebec government is stepping back its ZEV mandate from 100% zero-emission vehicles to 90% by 2035. This comes shortly after the province changed its vehicle eligibility to include hybrid vehicles.

- Honda is cancelling its Acura ZDX electric crossover after just 1 model year. The model which shares its platform with GM’s EV crossovers and the Honda Prologue variant will remain in production.

- Bentley’s first fully electric model has been spotted in development. It will be a crossover based on the same Premium Platform Electric as other VW Group EVs, like the Porsche Macan EV, Audi Q6 e-tron, and upcoming Porsche Cayenne EV.

- Vehicle lightweighting has been in process for manufacturers as fuel efficiency becomes more stringent. But as tariff costs rise to an anticipated $188 billion over the next3 years, and a smaller interest in overall industry fuel economy standards, car makers are looking at buying heavier but less costly materials to cut costs.

- Tariffs on Chinese goods are in an ‘informal review’ as the Canadian Federal government looks at its decision to impose 100% tariffs on Chinese EVs while China has imposed tariffs on Canola last month. This news comes as Canada tries to combat tariffs imposed on Canadian goods while also reviewing the Federal EV mandate.

- JLR has received a cyberattack that has affected service parts, vehicle sales, and assembly since it occurred on September 1st. JLR expects to resume normal business by October 1st, although the impacts have been measured at a cost of $50 million per week.