09.04.2024

Market Insights – 9/4/2024

Wholesale Prices, Week Ending August 31st, 2024

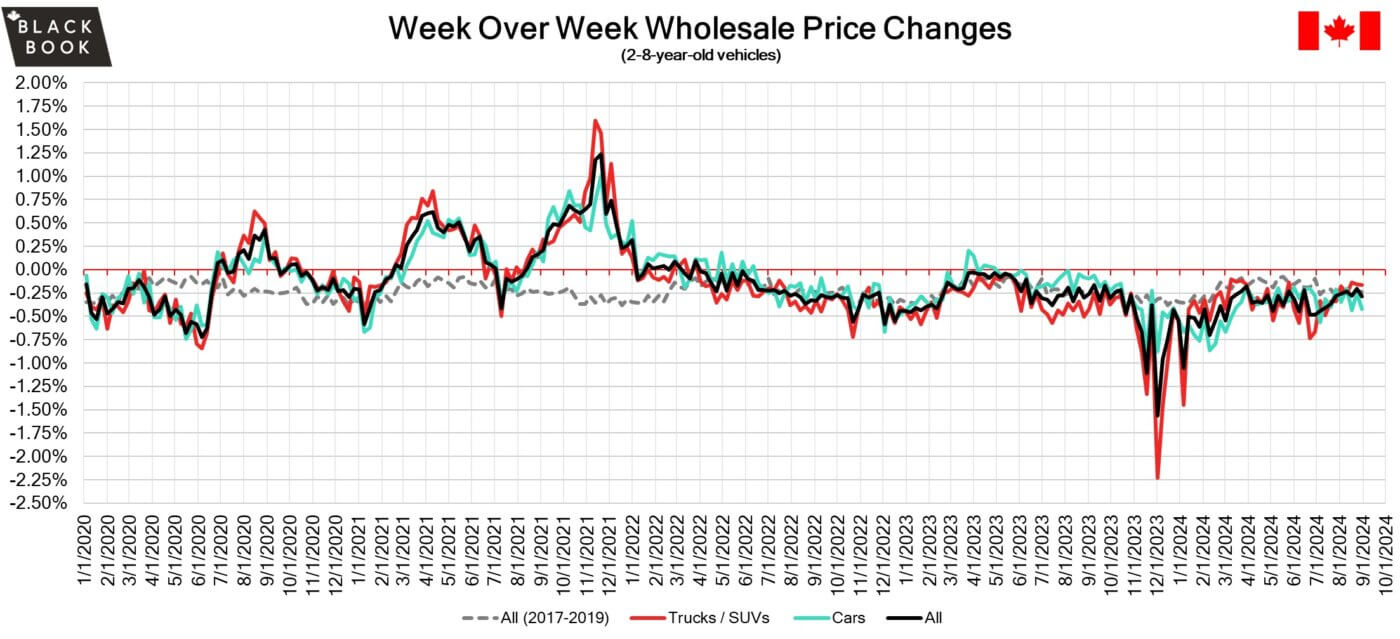

The Canadian used wholesale market experienced a decline of –0.29% in prices for the week. Car segments pricing decreased by –0.43% while the Truck/SUVs segments dropped -0.16% once again. Full-Size Pickups, and Compact Cars saw price increases of +0.51% and +0.09%. The largest declines noted were seen in Near Luxury Car with –0.87% followed by Luxury Car at –0.47% and Mid-Size Crossover/SUVs at –0.41%.

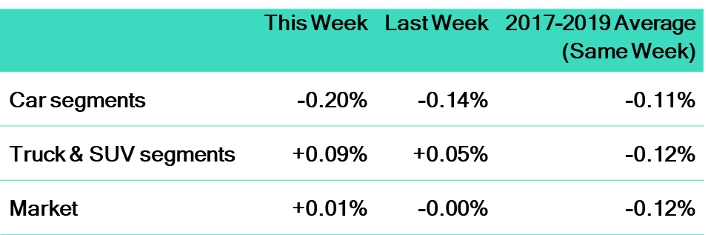

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.43% | -0.25% | -0.24% |

| Truck & SUV segments | -0.16% | -0.16% | -0.24% |

| Market | -0.29% | -0.20% | -0.24% |

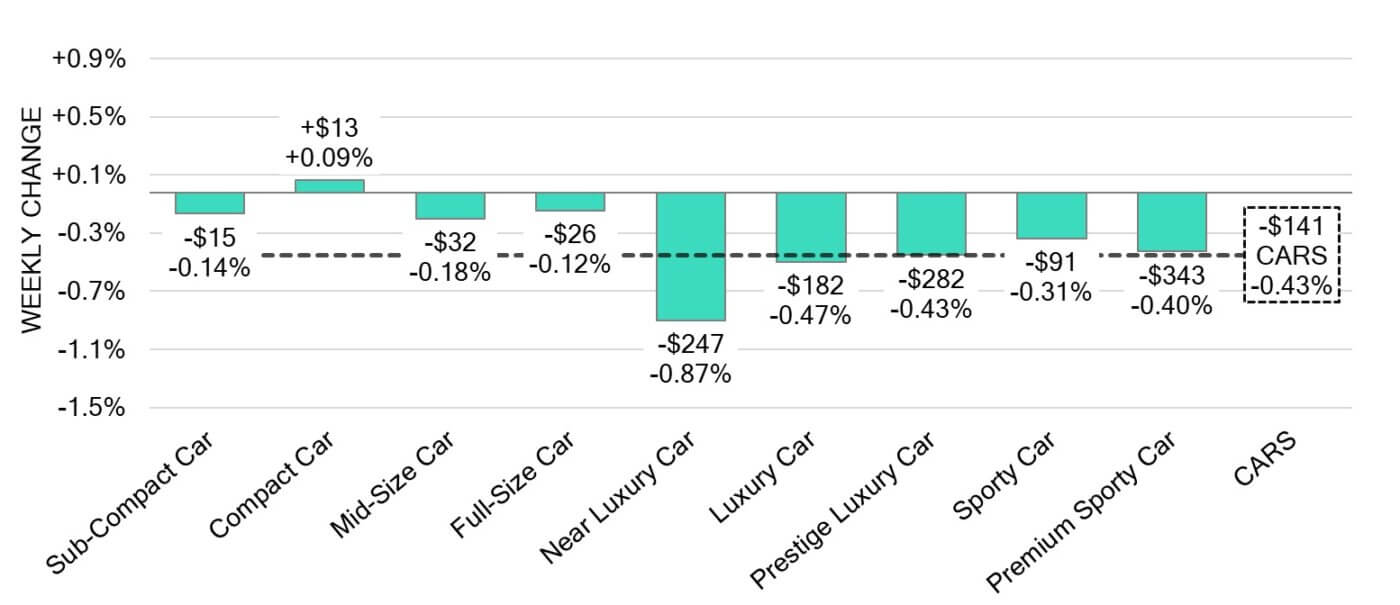

Car Segments

- Last week there was an overall decrease of -0.43% across Car segments. This decrease was noted across eight out of nine segments.

- The Compact Car segment (+0.09%) saw an increase, while Full-Size Car (-0.12%) and Sub-Compact Car (-0.14%) showed the smallest declines.

- The largest decreases were seen from Near Luxury Car (-0.87%), Luxury Car at (-0.47%) and Prestige Luxury Car at (-0.43%).

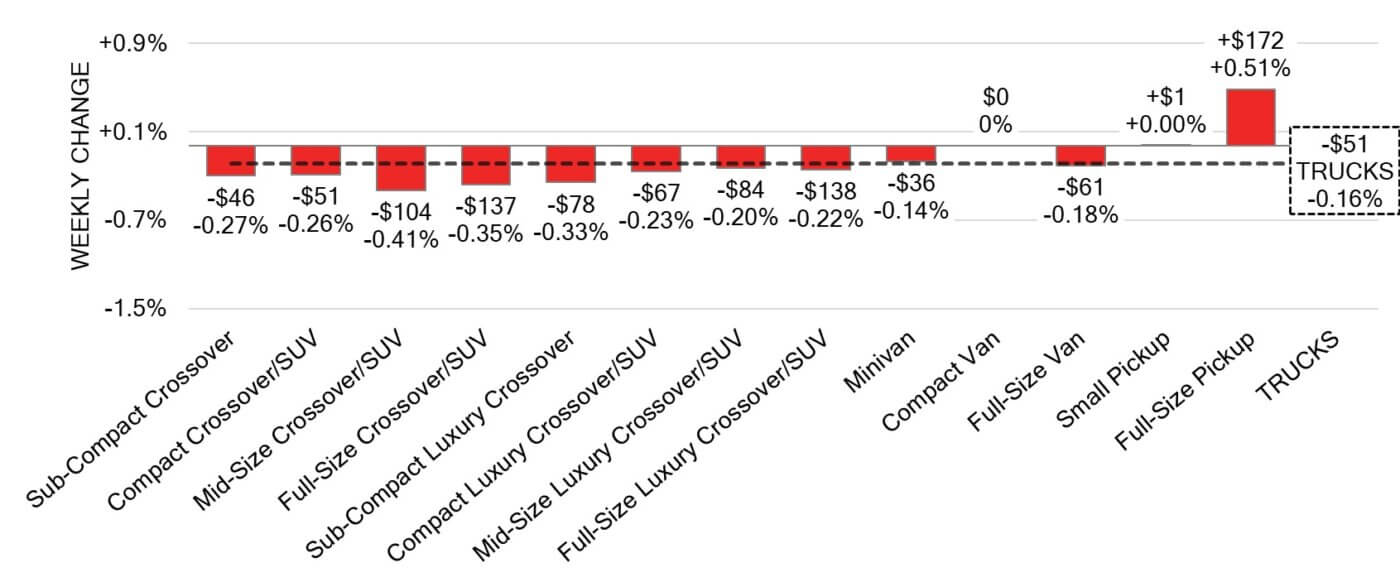

Truck / SUV Segments

- For the second week in a row, truck segments overall depreciation was –0.16%. This was seen within ten of the thirteen segments.

- Segments with the largest declines were Mid-Size Crossover/SUV (-0.41%), Full-Size Crossover/SUV (-0.35%) and Sub-Compact Luxury Crossover (-0.33%).

- Full-Size Pickups continued on an upward swing last week (+0.51%).

Wholesale

The Canadian market continues to trend downward, with a decline more pronounced than the previous week. Over 36% of market segments experienced an average value change of more than ±$100, which is nearly the same as last week. Among these, Car segments experienced a 18% larger decline compared to the previous week. Monitored auction sale rates ranged from 18% to 70%. The fluctuations in sale rates across various lanes can be attributed to the ongoing decline in floor prices. A decrease in supply entering the wholesale market has been noted as upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,200. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s economy grew 0.5% in the second quarter of 2024, following a 0.4% expansion in the previous quarter.

- In Q2 2024, Canada’s current account deficit widened to $8.5 billion, up from $5.4 billion in the previous quarter and exceeding market expectations.

- In June 2024, Canada’s government budget surplus narrowed to $0.94 billion, down from $2.11 billion in June 2023.

- The yield on the Canadian 10-year government bond increased slightly to 3.16%.

- The Canadian dollar is around $0.741 this Monday morning, representing a slight decline from $0.742 a week prior.

U.S. Market

- The market continued to report stability last week, with a majority of the truck and crossover/SUV segments experiencing an increase in values, resulting in an overall market uptick of +0.01%. In contrast, the same week pre-COVID averaged a decline of -0.12%.

Industry News

- Effective October 1st, Canada will impose 100% tariffs on Chinese-made electric vehicles, meeting the U.S. tariff. China is fighting back, accusing Canada of protectionism and stating the possibility of instability in the global industrial and supply chains, damaging trade relations in both countries.

- A new report from Dunsky Energy + Climate Advisors and The International Council on Clean Transportation (ICCT) is predicting an increased need for greater public charging from 643,000 level 2 and DC fast chargers to 679,000; all required by 2040 along with $300 million in electrical grid improvements.

- Hyundai Group’s luxury brand, Genesis will look to add hybrid powertrains as well as extended-range EV’s (EREV’s) to its current lineup as it adapts to slower EV adoption and the need for alternative fuel vehicles.

- Chinese automaker, BYD is pausing efforts on finalizing a location to build a Mexico factory to build its cars until it can conclude the outcome of the U.S. Federal election.

- The 2025 Chevrolet Equinox is now in production at the San Luis Potosi plant in Mexico, bringing to market the next generation of this popular nameplate. For the new generation, the gas trim lineup will start with the base LT at $35,443 and is equipped with FWD which will be followed by RS and Activ trims that will have AWD and simplify the Equinox lineup for 2025.