09.05.2023

Market Insights – 9/5/2023

Wholesale Prices, Week Ending September 2nd

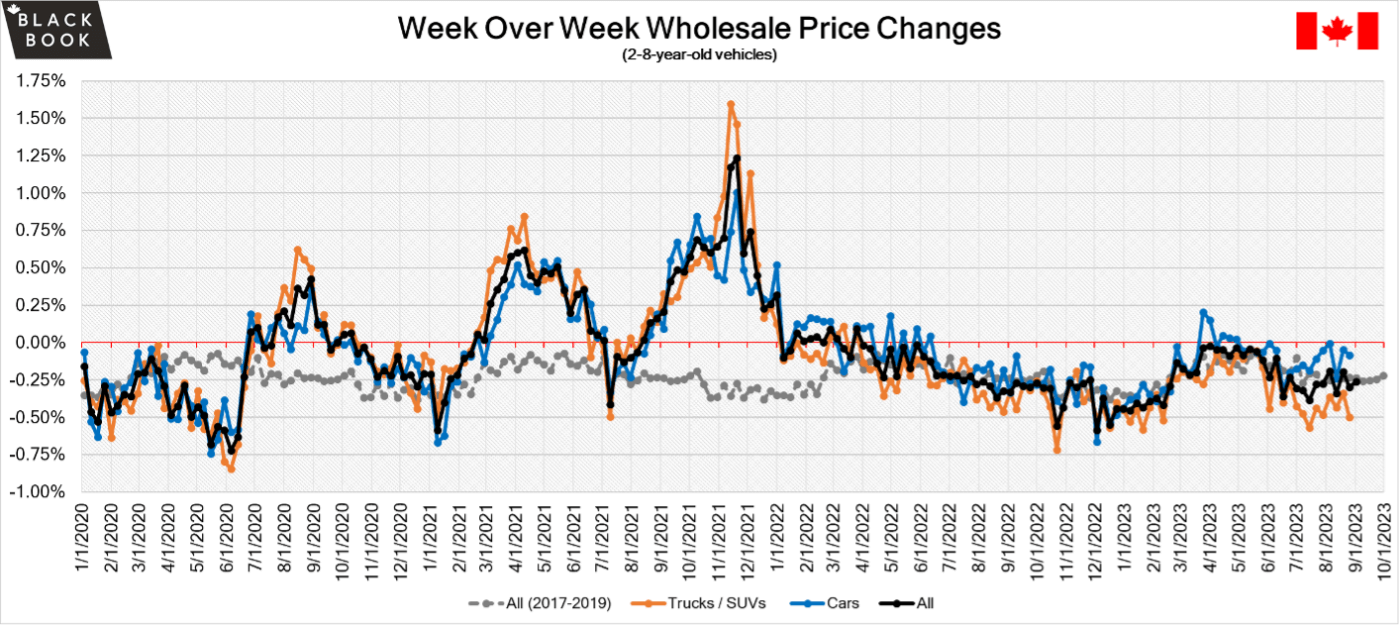

The Canadian used wholesale market saw a decline in prices for the week at -0.26%. The Car segment fell by -0.09% and the Truck/SUVs’ segment prices declined -0.42%. 3 out of 22 segments’ values have increased for the week. The Compact Van segment was up 0.61% followed by the Mid-Size Car segment at +0.14%. The segments with the largest declines were Full-Size Van at –0.93% followed by Full-Size Crossover/SUV at –0.74%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.09% | -0.08% | -0.24% |

| Truck & SUV segments | -0.42% | -0.50% | -0.24% |

| Market | -0.26% | -0.30% | -0.24% |

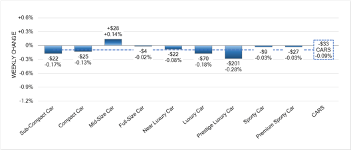

Car Segments

- There was an overall decrease of -0.09% within the Car Segments last week.

- Eight of the nine segments showed a drop in pricing. The segments with the largest decline were Prestige Luxury Car (-0.28%) followed by Luxury Car (-0.18%) and Sub-Compact Car (-0.17%).

- There was one segment with an increase. That segment was Mid-Size Car (+0.14%).

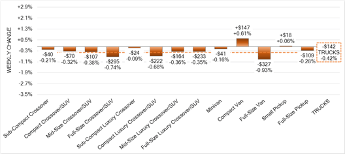

Truck Segments

- Last week there was an overall decrease of -0.42% in truck segments.

- Eleven of the thirteen truck segments showed a decline. Full-Size Van had the largest drop (-0.93%), followed by Full-Size Crossover/SUV (-0.74%) and Compact Luxury Crossover/SUV (-0.68%).

- Segments with an increase in value were Compact Van (+0.61%) and Small Pickup (+0.06%).

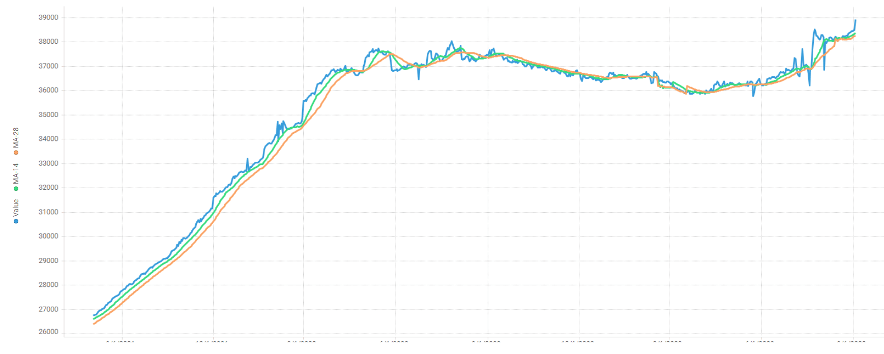

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,250. Analysis is based on approximately 189,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 16% but most were in the 35-45% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The Canadian government budget surplus narrowed to 2.1 billion dollars in June 2023 down from 4.9 billion dollars in June 2022.

- Home prices declined by 0.1% month over month in July after two months of increases.

- Canadian 10-year bond yields fell to 3.7% in last week.

- The Canadian dollar is around $0.735 this Monday morning down from $0.738 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.40% last week; the prior week decreased by -0.86%.

Volume-weighted Car segments decreased -1.44%, compared to the prior week’s -0.83% decrease:

- The 0-to-2-year-old Car segments were down -0.94% and 8-to-16-year-old Cars declined -1.57%.

- Eight of the nine Car segments decreased last week, and seven of those had declines exceeding 1%.

- Premium Sporty Car increased +0.70%, compared with the prior week’s increase of +0.46%. The increases continue to be driven by the strength of the prior generation Chevrolet Corvette by collectors.

- Mid-Size Car had the largest decline last week, down -2.10%.

- Compact Cars continue to have above normal depreciation, down -1.29% last week, but the rate of depreciation is slowing from the highs that exceeded 2% the first three weeks of August.

Volume-weighted Truck segments decreased by -1.38%; the previous week decreased -0.87%:

- The 0-to-2-year-old models declined -1.00% last week, while the 8-to-16-year-olds declined -1.26%.

- All thirteen Truck segments declined last week and all thirteen of the segments reported declines greater than 1%.

- The Full-Size Luxury Crossover/SUV segment had the largest decline at -1.99%, setting a record as the largest single week decline for the segment.

- The Small Pickup segment saw increased depreciation last week, down -1.85% compared with the prior week’s drop of -0.62%.

- Full-Size Vans had a large drop, with a decline of -1.39%, just shy of the record drop from December 2019 of -1.45%.

Industry News

- Hyundai is introducing heavily refreshed versions of its most popular and historically significant passenger cars, with its Sonata and Elantra, Midsize and Compact sedans. Hyundai is showing its commitment and confidence in sedans for today’s market amidst recent segment volume contraction – retained value for these segments shows strong demand as values have been some of the most stable in the car market this year.

- New electric vehicle start-up, Fisker, will be completing its first deliveries of its compact SUV, the Ocean, by the end of September even though the manufacturer is still waiting government approval as the vehicle is homologated for the Canadian market. Without a dealership model in place, the company will introduce retail and service locations in Vancouver and Toronto for now with plans for “Fisker-certified collision-repair centres” to come.

- New data from Natural Resources Canada shows that 1 in 5 federally funded EV charging stations is currently operational; with more than 43,000 chargers installed since 2016, roughly 8,600 are available and functioning for public use, as consumers site charging reliability and access as key obstacles to EV adoption in Canada.

- Service contracts are improving for EV owners as new and revised packages provide peace of mind over off-warranty EV repairs as these contracts are rewritten to focus on EV related risks which will provide a new revenue stream in the financing and insurance of electrified vehicles. LGM Financial says that retail prices for these EV-based extended service contracts begin at $3,500 and provide coverage for 10 years or 200,000 kilometers.