09.09.2025

Market Insights – 9/9/25

Wholesale Prices, Week Ending September 6th, 2025

The Canadian used wholesale market saw a decline of -0.29% in pricing for the week. Car segments prices decreased by –0.19% while the Truck/SUV segments decreased by -0.37%. This Weeks positive segment was Full-size Crossover/SUV at +0.15%. The largest declines in the Car segments were seen in Full-Size Car at -0.93% and Sporty Car with -0.32%. The largest declines in the Truck/SUV segments were Minivan at -0.87% followed by Full-size Luxury Crossover/SUV with -0.49%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.19% | -0.14% | -0.24% |

| Truck & SUV segments | -0.37% | -0.18% | -0.24% |

| Market | -0.29% | -0.16% | -0.24% |

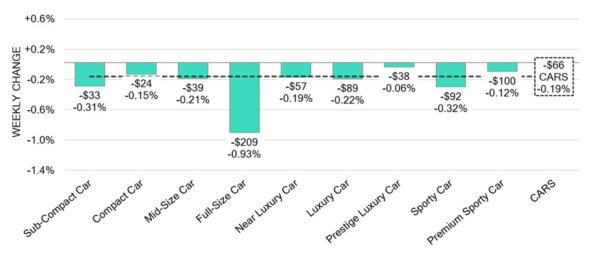

Car Segments

- A depreciation of -0.19% was witnessed in car segments last week. All nine categories reflected this movement.

- The most significant declines were seen in Full-Size Car (-0.93%), Sporty Car (-0.32%), and Sub-Compact Car (-0.31%).

- Segments with the smallest declines were Prestige Luxury Car (-0.06%), Premium Sporty Car (-0.12%), and Compact Car (-0.15%).

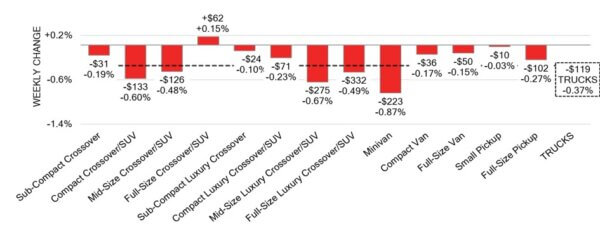

Truck / SUV Segments

- There was an overall decline of -0.37% in truck segments last week. Twelve of the thirteen categories returned this change.

- Segments with the largest declines were Minivan (-0.87%), Mid-Size Luxury Crossover (-0.67%), Compact Crossover/SUV (-0.60%) and Full-Size Luxury Crossover/SUV (-0.49%).

- One segment showed an increase in values. That segment was Full-Size Crossover/SUV (+0.15%).

Wholesale

The Canadian market remains on a downward trajectory, showing a steeper decline compared to in its prior week. Car segments experienced a 0.05% adjustment, resulting in a –0.19% drop. Similarly, truck segment values recorded a 0.19% change bringing the total decline to –0.37%. Slightly more than 36% of market segments recorded an average value change exceeding ±$100. The week’s monitored auction sale rates ranged from 16.9% to 50.9%, averaging 31.2%. Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices. Supply levels remain stable; however, upstream channels are still gaining priority sale access to inventory. Demand for inventory and high-quality vehicles persists at auctions on both sides of the border.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,700. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada recorded a trade deficit of $4.9 billion in July 2025, narrowing from a

revised $6.0 billion shortfall in June, but slightly exceeding market expectations of

$4.75 billion. - The S&P Global Canada Manufacturing PMI increased to 48.3 in August 2025

from 46.1 in July, signaling a slower pace of contraction in the country’s private sector

manufacturing activity. - The S&P Global Canada Composite PMI slipped to 48.4 in August 2025 from

48.7 in July, its second-highest reading of the year, yet still indicating a ninth

straight month of contraction in private-sector activity. - The yield on the Canadian 10-year government bond decreased to 3.18%.

- The Canadian dollar is around $0.724 this Monday morning, down slightly from

$0.725 a week prior.

U.S. Market

- Post-Labor Day, lane activity slowed as conversion rates dipped, and depreciation resumed in line with late-summer norms. While last year was unusual—showing positive trends both before and after the holiday—this year’s pre-Labor Day period was merely stable, with a few segments gaining. That strength faded last week as depreciation followed the more typical early-September pattern.

Industry News

- Prime Minister Mark Carney is launching a 60-day review of the federal government’s ZEV mandate, delaying the 2026 target of 20% for another year while decisions will be made on the financial support and target level going forward.

- August auto sales were down year-over-year, as the market sees its first decline since February. An estimated 160,000 units were sold, marking a 2.9% decrease against 2024, with one less selling day than last year.

- BMW released photos and information about its electric iX3 crossover, the first “Neue Klasse” generation of vehicles in its advanced software-defined vehicle development program. The iX3 brings 800V architecture to the brand, quoting range of up to 800km on a single charge and charging of up to400kW via DC-Fast charging.

- Honda will be bringing the ‘Prelude” nameplate back for 2026MY as a hybrid-only sports coupe. Adopting suspension dampening and brakes from the Civic Type R, and the hybrid powertrain from the Civic Hybrid. This will be the first 2-door brought to market since discontinuing Accord and Civic coupes late in the last decade.

- Mercedes-Benz will be introducing its next generation GLC crossover first as an EV, with its new EQ Technology naming convention. Arriving to compete with BMW’s iX3, it will also be equipped with 800V architecture. The new electric GLC achieves charging up to360kW and a range of up to 713km.

- The Quebec government is pulling funding it devoted to Northvolt’s $7 billion EV battery facility outside of Montreal. Citing that Northvolt, “did not present a satisfactory plan with respect to Quebec’s interests”.