11.03.2025

The Future of Electric Vehicles in Canada: Market Dynamics After the iZEV Rebate

Canada’s transition toward zero-emission vehicles (ZEVs) is a cornerstone of its climate strategy and its commitment to achieving 100% ZEV sales by 2035. Since 2019, the federal Incentive for Zero-Emission Vehicles (iZEV program) has served as a primary driver of adoption, reducing upfront costs and accelerating consumer adoption. As the federal rebate program is now discontinued, the Canadian automotive market is entering a new stage of maturity—one defined less by policy support and more by market fundamentals.

This paper examines the Canadian ZEV market before and after the iZEV rebate, the evolving incentive landscape and its implications for future values, and how the market can sustain EV adoption in a post-rebate environment.

The Canadian ZEV Market: Before and After the iZEV Rebate

Before the Rebate Removal

Introduced in 2019, the federal iZEV program provided consumers up to $5,000 toward eligible battery-electric and plug-in hybrid vehicles. By reducing the price gap between electric and internal combustion engine (ICE) vehicles, the rebate meaningfully accelerated EV adoption—especially when combined with provincial incentives in Quebec, British Columbia, and several Atlantic provinces. In total, the financial support provided over its 6-year run amounted to $2.6 billion helping 560,000 ZEVs reach Canadian roads and springboard the market for Canada.

Between 2019 and 2024, Canada’s ZEV market share grew from roughly 3% to over 15% of new light vehicle sales. With nation-leading ZEV markets in Quebec and British Columbia, those provincial programs helped develop not only ZEV share of sales, but also consumer education, charging infrastructure, and an impending source of used EV supply, which will support greater affordability of EVs in the future. This combination of rebates, improved charging infrastructure, and greater model variety has driven broader consumer confidence and manufacturer investment. Helping automakers expand their EV portfolios, adapt their dealers to new technologies, and begin building a North American battery and assembly supply chain that can help support the Global EV landscape.

Post Rebate Environment

The removal of the iZEV rebate is expected to introduce short-term headwinds. Entry-level EVs are experiencing effective price increases of 8–12%, likely softening demand among cost-sensitive, mainstream market consumers. With the impacts concentrated towards lower priced EVs, the market will develop its remaining sales volume around more expensive, premium and luxury electric models, which we believe will reduce the opportunity of the scalability of new technology and exacerbate the general unaffordability of EVs. Without federal support, adoption may become more uneven across regions—remaining strong in provinces that maintain an incentive but slowing down elsewhere.

Fleet and commercial operators, which depend on predictable cost structures, may delay electrification until vehicle pricing stabilizes or long-term cost benefits are clearer. However, as with the consumer segment, higher-income private buyers and corporate fleets are likely to maintain demand, preventing a full market slowdown. In the end, the rebate’s removal will reveal the market’s maturity and whether Canada has passed its tipping point for electric vehicle adoption.

The short-term impact will likely reduce ZEV market share, as seen in early 2025, but should stabilize for a more sustainable long-term transition to electrified vehicles. The sentiment from Canadian Black Book is that a higher share of premium EVs will lower average retention rates, pushing residual values down over the next 12–24 months. Meanwhile, mainstream pre-2025 EVs already on the market will become more desirable amid higher prices, supporting stronger mid- to long-term residuals. Though our outlook on these vehicles is reduced, manufacturers’ extended timelines for new electric models reflect a shift toward organic market growth, cost reductions through scale, and progress in consumer education and infrastructure—both now given room to catch up.

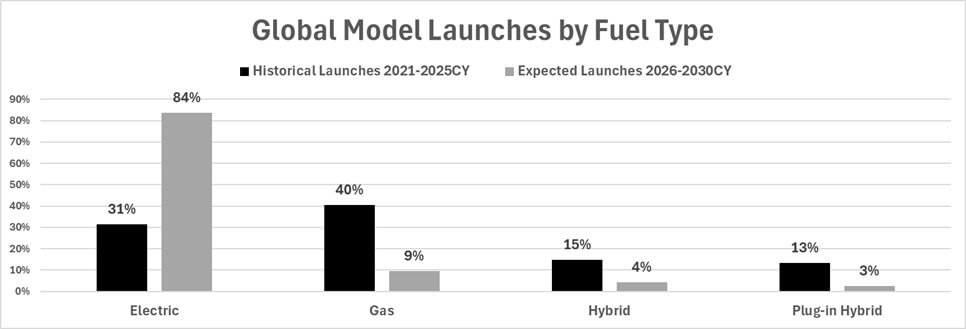

Giving a lens into the global slowdown of EV transition, we’ve graphed out the model launches prior to the midpoint of this decade versus what is still expected to come. With a vastly diminished 60% decrease of model launches in 2026-2030, there’s still a continual global shift towards EVs forecasted. Whether the North American market sees these vehicles arrive earlier or later to market, the plans in place signify that we have a defined long-term strategy to decrease emissions of greenhouse gas from the global fleet.

Although this data looks as though we won’t have the necessary options to offer the current consumer body in the future, it must be stressed that manufacturers are supporting a slowing EV transition with the introduction of more hybrid and plug-in hybrid powertrains to support their current model lineups which is not covered here. Concerns still loom large on the mass market transition becoming fully electric as it is now guaranteed to take more time than hoped.

The Incentive Landscape and Its Impact on Future Values

EV incentive structures have evolved into a multi-tiered ecosystem comprising federal, provincial, and manufacturer-led programs. While the federal iZEV program provided national impact, provincial rebates—such as those previously mentioned—remain critical. Although this has made it increasingly difficult to assess a precise value for this market segment, it has allowed for maximum growth in a minimal time frame. Offsetting the fallout of the EV market, automakers have increasingly introduced their own initiatives, including loyalty discounts, subsidized leases, and charging infrastructure credits, to maintain competitiveness and overall consumer consideration.

Analyzing the Cash incentives in lieu of the absence of a federal rebate, the market has done a respectable job supporting some of the financial backing necessary to stabilize consumer interest. In a study of 27 electric models (70% mainstream, 30% premium), 48% still offered a cash incentive as of October, with 90% of mainstream models averaging $5,000 toward a cash purchase. While this level of support has helped preserve sales momentum, the wide incentive range, witnessed at up to $21,000, highlights growing financial strain for manufacturers competing in a declining market.

These programs have also had measurable effects on residual values. Historically, our EV residuals lagged comparable ICE vehicles due to technology uncertainty, causing broad consumer lack of demand and rapid depreciation. However, as EV technology has matured and demand is more stabilized, residual performance improved. We find that the gradual phase-out of rebates introduces a new dynamic:

- If new EV prices rise post-rebate, used EVs may hold stronger relative value, narrowing the price gap for the used market.

- If demand weakens significantly, RVs could soften due to slower turnover and reduced lease demand.

Residual forecasting will become more complex, requiring an account for multiple variables like policy volatility, evolving supply-demand balance, charging infrastructure, long-term confidence in battery durability and state of health measures.

Sustaining EV Adoption Without a Federal Rebate

While rebates have been instrumental in building early momentum, sustainable growth will depend on market-driven mechanisms and structural enablers that reduce dependence on government incentives.

Cost Parity and Manufacturing Scale

Battery costs have declined nearly 90% over the past decade and are expected to continue falling as technology advances and domestic supply chains mature. The goal is to achieve at least a $100/kWh cost (USD) for EV batteries, and as production scales and logistics localize, price parity with ICE vehicles is projected to occur later this decade, reducing the need for such subsidies.

Infrastructure and Consumer Experience

A seamless charging ecosystem is now the most critical factor for continued growth in this segment. Investments from both public and private sectors—through programs such as Natural Resources Canada’s ZEV Infrastructure Program and the onboarding of Legacy manufacturers to more highly developed charging networks—will help alleviate consumer concerns around accessibility and convenience. Confidence in charging infrastructure will increasingly replace rebates as a primary purchase driver.

Fleet Electrification and Organizational Commitment

Corporate and government fleets are emerging as powerful catalysts for ZEV adoption. Driven by sustainability mandates and long-term total cost of ownership advantages, fleets are expected to continue electrifying regardless of rebate changes. Their participation will also accelerate the used EV pipeline, improving availability and affordability for secondary buyers.

The phase-out of the iZEV rebate represents a turning point for Canada’s electric vehicle market. While a temporary slowdown has been underway for the greater half of 2025, the broader transition toward electrification remains firmly underway. Falling production costs, increasing availability of infrastructure, and growing consumer confidence in New and Used EVs will underpin continued progress.

The market is now shifting from a policy-driven growth plan to a performance-driven one—a sign of maturity rather than fragility. Success in this next phase will depend on collaboration across our market’s manufacturers, financial institutions, and policymakers to continue improving affordability, strengthening residual values, and ensuring a seamless ownership experience.

Ultimately, Canadian Black Book’s stance on Canada’s ability to sustain EV momentum without direct federal incentives will fall on Manufacturers to push these models to be the vehicles Canadians want to purchase, decreasing their financial burden on the broader brand lineup over time and deepening the effort behind educating consumers to understand that historically large obstacles are falling down quarter by quarter. With this already underway, the opportunity for long-term values to sustain and improve is great. This is will the ability to demonstrate the long-term viability of Canada’s zero-emission future—and its readiness to compete in a global electric mobility economy.

Posted in: Auto Finance, Dealers, In the News, Lenders, OEM, Remarketing