12.16.2025

Market Insights – 12/16/25

Wholesale Prices, Week Ending December 13th, 2025

The Canadian used wholesale market saw a decline of -0.58% in pricing for the week. Car segments prices decreased by –0.46% while the Truck/SUV segments decreased by -0.52%. The largest declines in the Car segments were seen in Sub-Compact Car at -1.28% and Full-Size Car with -1.27%. The largest declines in the Truck/SUV segments were Compact Van with -1.21% followed by Full -Size Luxury Crossover/SUV at -1.02%

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.46% | -0.43% | -0.35% |

| Truck & SUV segments | -0.52% | -0.78% | -0.26% |

| Market | -0.50% | -0.62% | -0.30% |

Car Segments

- Last week car values softened, with overall car prices down 0.46 percent on average across the market.

- The largest depreciations were seen in Sub-Compact Car (-1.28%), Full-Size Car (-1.27%), Sporty Car (-0.63%), and Luxury Car (-0.52%).

- The smallest declines were recorded in Near Luxury Car (-0.31%), Compact Car (-0.33%), and Premium Sporty Car (-0.34%).

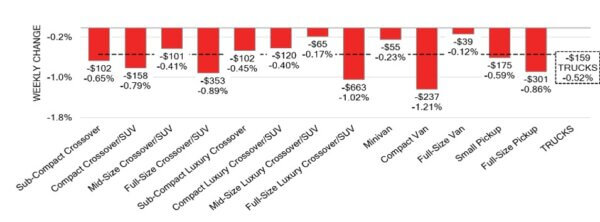

Truck / SUV Segments

- Last week, truck values edged lower overall, with the market down 0.52 percent.

- The largest declines were seen in Compact Van (-1.21%), Full-Size Luxury Crossover/SUV (-1.02%), and Full-Size Crossover/SUV (-0.89%), with Full-Size Pickup (-0.86%) also posting a notable drop.

- The smallest movements were recorded in Full-Size Van (-0.12%), Mid-Size Luxury Crossover/SUV (-0.17%), and Minivan (-0.23%).

Wholesale

The Canadian market continues trending downward; the rate of decline that has slowed in comparison to last week’s results. Truck segment values shifted by 0.26%, bringing the total decline to –0.52%. Car segment values recorded a 0.03% adjustment, bringing the total decline to –0.46%. Just under 73% of market segments recorded an average value change exceeding ±$100. Monitored auction sale rates this week varied between 16% and 74.6%, averaging at 35.3%. Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices. Supply has stabilized and returned to regular levels; however, upstream channels continue to hold priority sale access to inventory. Buyer demand for high-quality vehicles at auctions on both sides of the border persists.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $36,650. This analysis is based on approximately 198,450 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada held its target overnight rate at 2.25% in December 2025,

maintaining the Bank Rate at 2.50% and the deposit rate at 2.20%, after

indicating in October that the policy rate was appropriately positioned. - Canada’s trade balance shifted to a $0.15 billion surplus in September 2025,

reversing a $6.3 billion deficit in August and sharply beating expectations for a

$4.5 billion shortfall. It marked the nation’s second trade surplus of the year. - Canada’s exports jumped 6.3% month-over-month to C$64.2 billion in September

2025, rebounding from a 3.2% decline and posting the strongest monthly gain

since February 2024. - Housing starts in Canada rose by 9.4% month-over-month in November 2025,

rebounding from a 17% drop in October to reach a seasonally adjusted annual

rate of 254,058 units, slightly exceeding the market forecast of 250,000. - The yield on the Canadian 10-year government bond increased to 3.37%.

- The Canadian dollar is around $0.726 this Monday morning, up slightly from

$0.722 a week prior.

U.S. Market

- Depreciation remained concentrated in mainstream segments, while luxury and premium models held comparatively steady. Mid-Size Cars posted the steepest drop among car segments, and Mid-Size Crossovers led the declines within trucks and SUVs. Despite typical year-end softening, auction conversion improved to 59%, signaling steady buyer engagement and competitive bidding for clean, late-model units.

Industry News

- Canadian zero emission vehicle share fell to 8.9% in October, which is a 42% decline YoY when the share was 15.2% as Federal and Provincial incentives were active in the market. This monthly metric fell from a 2025 high (post Federal rebate) in September of 10.2%.

- GM Canada has named its next President, Jack Uppal who will take over for Kristian Aquilina as of February 1st. Uppal, a Toronto native who has been with the brand since 2001 and has held senior leadership positions in China, India, the Middle East and Singapore, will succeed Aquilina who moves on as the Global VP of Cadillac.

- One-month post the U.S. EV rebate removal, and the winners and losers have been assigned through October results. EV registrations were up for Tesla, Cadillac, Rivian and GMC while they were down for Ford, Chevrolet, Hyundai and Kia. Overall analysts report the impact was not as large as expected.

- Nissan is looking to undercut the current “Autopilot” autonomous driving system from Tesla with its own $4,000 self-driving system by 2028. Nissan Americas Product Planning Chief, Ponz Pandikuthira says “the company has a renewed interest in having truly capable self-driving systems in their cars”.

- When Kia launches its newest EV, the EV4 sedan in 2026, it will be the least expensive EV on sale in Canada. The electric sedan which aims to compete against others like the Tesla Model 3 will be priced starting at $38,995 and offer EPA tested range of up to 552 kilometers. With freight, PDI and fees, this price is expected to be around $42,000.

- Nissan Americas Chair, Christian Meunier says that if Canada expands its safety standards, the brand could provide cheaper, smaller cars to this market.