03.25.2025

Market Insights – 3/25/25

Wholesale Prices, Week Ending March 22nd, 2025

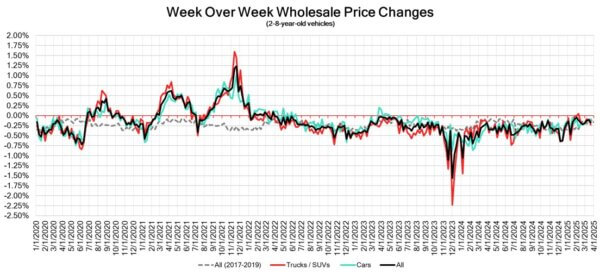

The Canadian used wholesale market experienced a decline of –0.17% in pricing for the week. Car segments prices decreased by –0.11% while the Truck/SUVs segments decreased by -0.22%. The largest increases were seen in Full size Pickup at +0.22% and Full-Size Crossover/SUV at +0.20%. The largest declines in the car segments were seen in Sub-Compact Car at -0.45% and Compact Car with -0.32%. The largest declines in the Truck/SUV segments were Full-Size Van at -1.37% followed by Compact Van with -1.03%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.11% | -0.09% | -0.01% |

| Truck & SUV segments | -0.22% | -0.12% | -0.19% |

| Market | -0.17% | -0.10% | -0.09% |

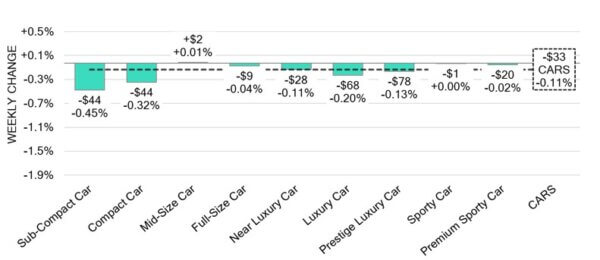

Car Segments

- There was an overall depreciation of –0.11% seen in car segments last week. This decline was reflected across eight of the nine car segments.

- Segments with the largest reductions were Sub-Compact Car (-0.45%), Compact Car (-0.32%) and Luxury Car (-0.20%).

- One segment showed a very nominal increase. That segment was Mid-Size Car (+0.01%).

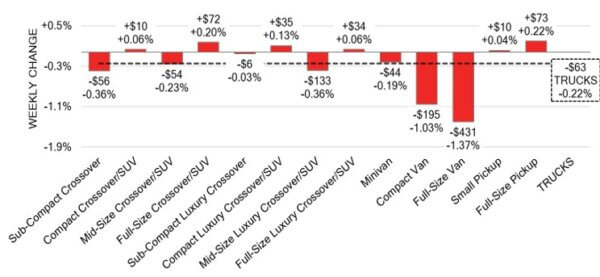

Truck / SUV Segments

- Truck segments showed an overall decrease of –0.22% last week. Seven of the thirteen segments reflected this change.

- Those with the largest declines were Full-Size Van (-1.37%), Compact Van (-1.03%). Sub-Compact Crossover and Mid-Size Luxury Crossover/SUV has the same decline (-0.36%).

- Six segments had an increase. Those with the largest were Full-Size Pickup (+0.22%) and Full-Size Crossover/SUV (+0.20%).

Wholesale

The Canadian market continues to reflect downward trend, with a decline slightly more pronounced compared to its previous week. Just over 13% of the market segments experienced an average value change of more than ±$100. The decrease in the truck segments rose to –0.22%, while the decline of the car segments also experienced an increase, bringing its change to –0.11%. Monitored auction sale rates ranged from 32.3 to 71.4% averaging at 52.3%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including recent political variances and the ongoing gradual decline/change in floor prices. A slight increase in supply entering the wholesale market has been noted, however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $34,950. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s CFIB Business Barometer long-term index, measuring 12-month

forward expectations for business performance, dropped 24.8 points to an all-time

low of 25.0 in March 2025. This decline surpassed levels recorded during the

2020 pandemic, the 2008 financial crisis, and the 9/11 attacks. - Retail sales in Canada are expected to decrease by 0.4% from the previous

month in February 2025, based on preliminary estimates. - The Raw Materials Price Index in Canada increased by 0.3% month-over-month

in February 2025, slowing down from a 3.5% rise in January and surpassing

expectations of a 0.3% decline. - The yield on the Canadian 10-year government bond increased to 3.06%.

- The Canadian dollar is around $0.698 this Monday morning, representing a slight

decrease from $0.699 a week prior.

U.S. Market

- The market had another impressive week. To put it into perspective, the average value of 2-to-8-year-old vehicles rose by 0.29% last week, surpassing the highest pre-pandemic spring market weekly increase of +0.12%. Typically, the largest spring market increase occurs in mid-April, not mid-March.

Industry News

- Ford has identified a particular cost issue with incoming tariffs that will affect Ford Super Duty Pickup trucks which have their engines built in Canada and Mexico. The cost incurred by President Trumps 25% tariffs according to Unifor Local 200 President John D’Agnolo will amount to one truckload of engines requiring a $75,000 USD duty to be paid if transported across the border.

- The Vancouver International Auto Show has removed Tesla from the show floor, citing concerns over security and safety as the brand has seen public retaliation against company CEO Elon Musk.

- At an event in China, carmaker BYD showcased its latest “flash-charging” batteries that can spin at over 30,000rpmenabling one megawatt of charging power which is enough to charge at 2km per second, which can charge around 400km into a battery over 5 minutes – similar refueling time togas cars.

- TD Economics has released a report on lifetime vehicle emissions by fuel type, and finds that over the lifecycle of ownership, an EV’s emissions savings range between 70-77% greater than ICE’s (internal combustion engines). The savings are lesser in regions that rely more heavily on coal, like Nunavut.

- SWTCH energy, a Toronto-based EV charging company has built a new system for chargingin multi-urban residential buildings (MURB’s) that has been a reason for slower EV adoption in the country. The new system which is already operating in Ottawa improves efficiency while significantly cutting down on cost.

- Provincial parties in both Manitoba and Nova Scotia have removed EV rebates for Tesla models citing CEO Elon Musk’s association with the trade war on Canada.