08.06.2024

Market Insights – 8/6/2024

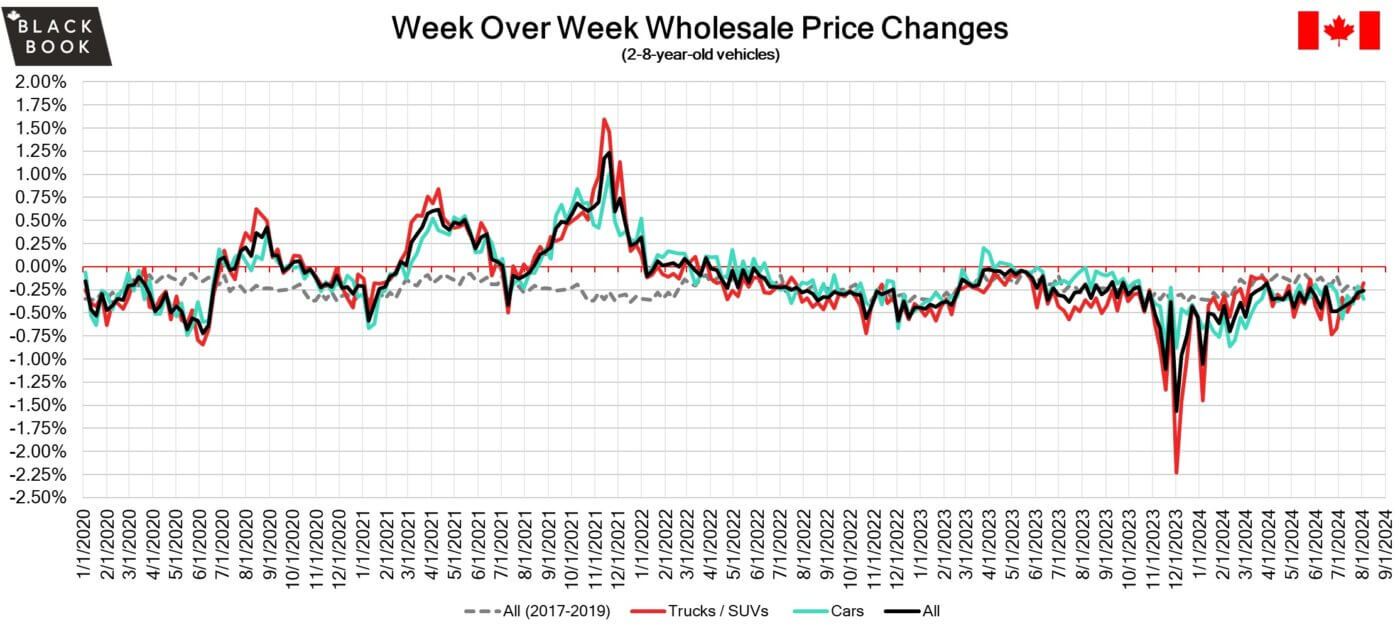

Wholesale Prices, Week Ending August 3rd, 2024

The Canadian used wholesale market saw a decline in prices for the week at –0.26%. The Car segment fell by –0.35% and the Truck/SUVs segment prices declined -0.18%. The top 2 Segment with positive changes this week were Minivan with +0.45 and Sub-Compact Luxury Crossover +0.17 . Car segments with the largest declines were Sub-Compact Car at –0.81% followed by Prestige Luxury Car at –0.54%.The largest declines for the Truck/SUV segments were, Compact Luxury Crossover/SUV at –0.42% followed by Compact Crossover/SUV at –0.31%.

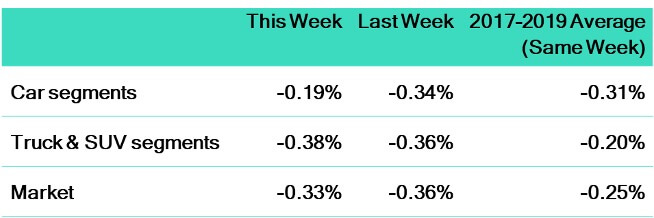

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.35% | -0.21% | -0.22% |

| Truck & SUV segments | -0.18% | -0.34% | -0.29% |

| Market | -0.26% | -0.28% | -0.25% |

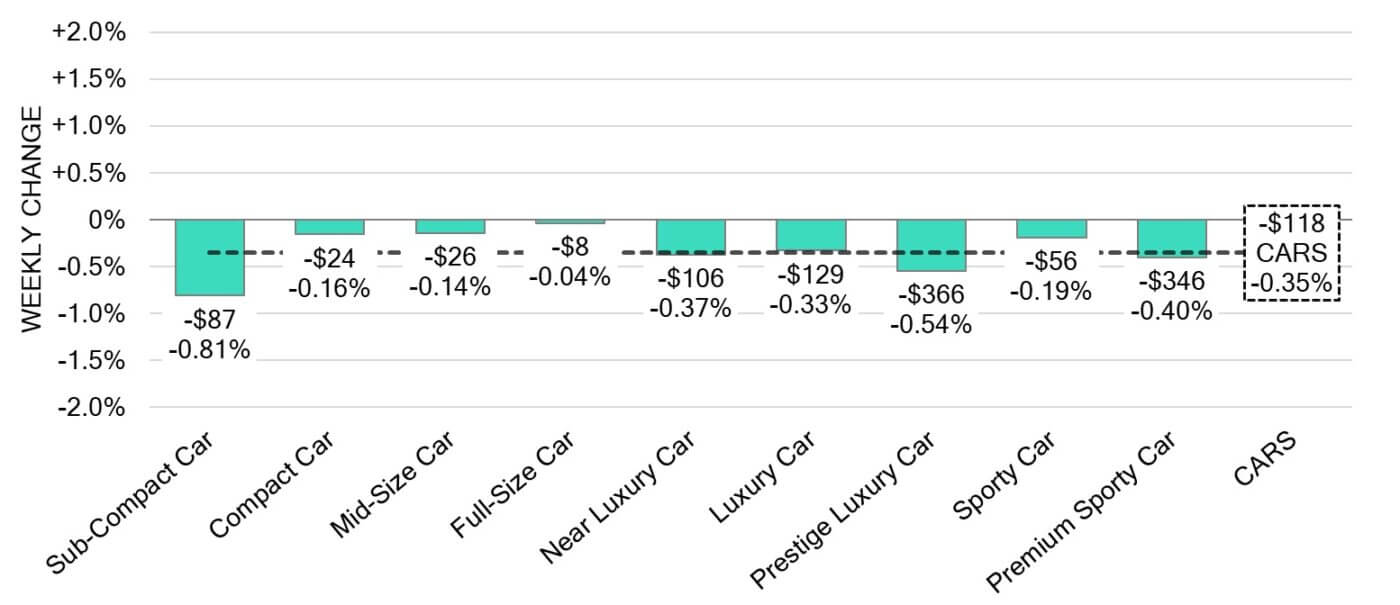

Car Segments

- Last week there was an overall decrease of -0.35% across Car segments. This decrease was noted across all nine segments.

- The Full-Size Car (-0.04%) segment showed the smallest change, with Mid-Size Car (-0.14%) and Compact Car (-0.16%) showing the next smallest declines.

- The largest decreases were seen from Sub-Compact Car (-0.81%), Prestige Luxury Car at (-0.54%) and Premium Sporty Car at (-0.40%).

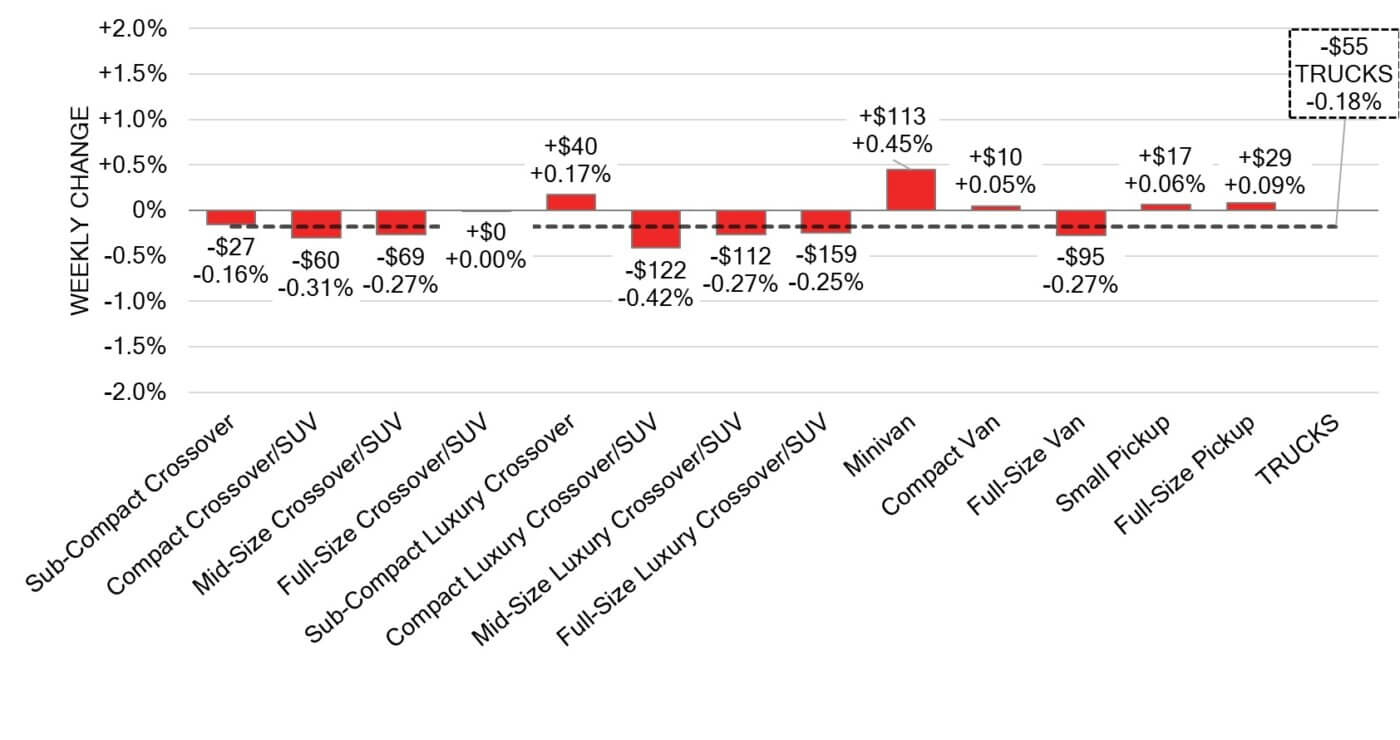

Truck / SUV Segments

- There was an overall softening of –0.18% seen in wholesale truck segments last week. Eight of the thirteen segments showed a decrease.

- Those with the largest depreciations were Compact Luxury Crossover/SUV (-0.42%) and Compact Crossover/SUV (-0.31%). Mid-Size Crossover/SUV, Mid-Size Luxury Crossover/SUV and Full-Size Van all had the same decrease (-0.27%).

- There were five segments with increases. Minivan (+0.45%) and Sub-Compact Luxury Crossover (+0.17%) had the largest.

Wholesale

The Canadian market continues to show a steady gradual decline. More than 35% of market segments saw an average value change greater than ±$100, showing an increase compared to the previous week. Among these segments, Car segments saw a decrease 17% larger than that observed in the Truck segments. Monitored auction sale rates ranged from 20% to 64%. A continued drop in floor prices highlights the variations in sale rates across different lanes. With more supply entering the wholesale market and upstream channels securing early access, there continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

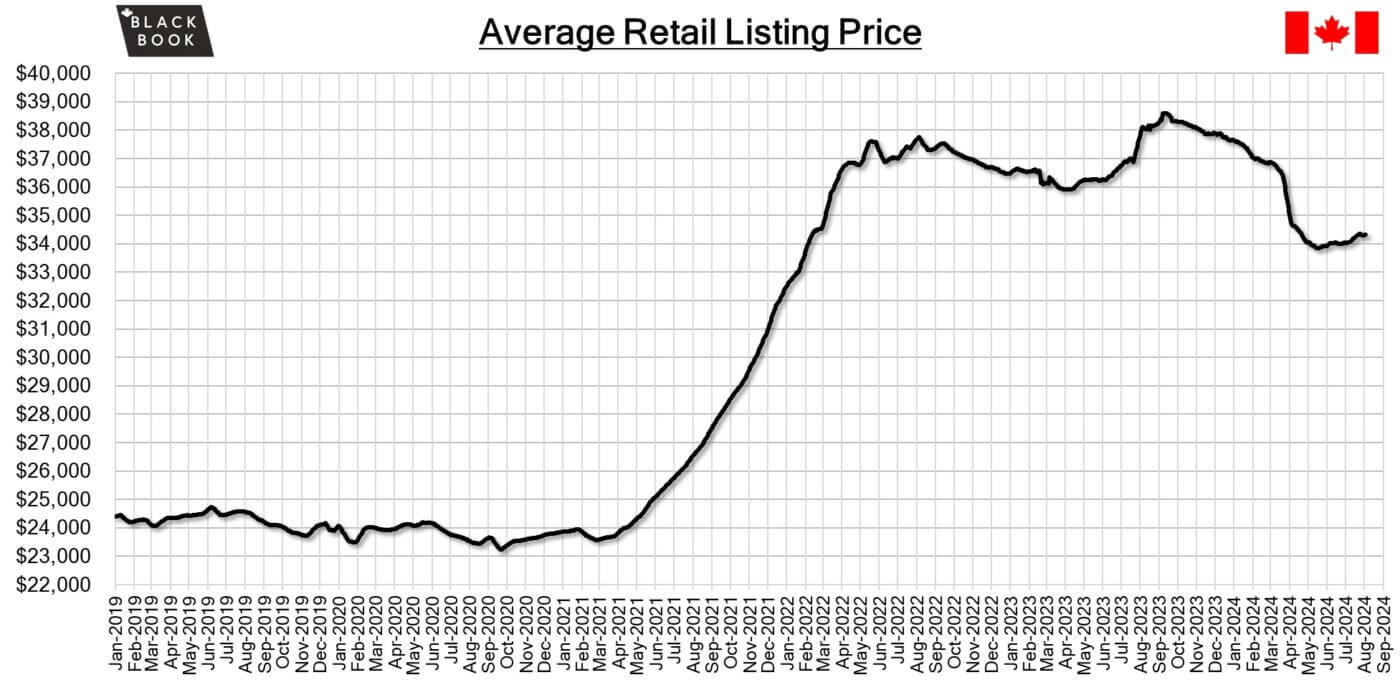

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,300. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- According to the latest forecast, Canada’s economy is projected to expand by 0.1% in June 2024. The growth will be driven by increased activities in construction, real estate, rental & leasing, and finance & insurance sectors. However, these gains are expected to be attenuated by declines in manufacturing and wholesale trade.

- In June 2024, Canada saw a trade surplus of CAD 0.64 billion, marking the first surplus since February. This positive development follows a revised deficit of CAD 1.61 billion in May and contrasts with market expectations of a CAD 1.84 billion gap.

- The yield on the Canadian 10-year government bond fell further to 2.97%.

- The Canadian dollar is around $0.723 this Monday morning, representing very little change from $0.722 a week prior.

U.S. Market

- The second half of the year is maintaining a stable position. Following some volatility earlier this summer, likely linked to the CDK Global outage, the market is now stabilizing, with depreciation returning to typical seasonal patterns. Auction attendance remains strong, and conversion rates are consistently solid, hovering in the high 50-percent range.

Industry News

- New vehicle sales were an estimated 161,000 up in July by 11%, says Desrosiers Automotive Consultants, after comparing a weak month last year and succeeding a June that was riddled with software issues that held back sales which were pushed into July. In 2019 (the last July prior to COVID-19 impacts) sales reached 173,519.

- Chinese automaker BYD (an acronym for Build Your Dreams) is eyeing an entry into the Canadian car market of EV’s not only for sale within Canada but also as a point of access into the United States, as recently the U.S. has introduced tariffs on Chinese-made vehicles into the region.

- Two automakers operating in Canada are in legal disputes with their dealer body. Honda dealers are readying for a legal battle as Honda Canada is aiming at significantly reducing profit margins, while JLR (Jaguar Land Rover) Canada dealers are seeking legal support as the brand plans to reduce its dealer count while implementing a product strategy to reduce model nameplates in effort to transition to electric models only by 2025.

- Ford Maverick gets a mid-cycle refresh for 2025MY, as it just released the upcoming changes in looks and equipment, the hybrid model will now receive all-wheel-drive and the infotainment system gets an upgraded screen that is larger. 2025MY Maverick will start at $36,695 including shipping.

- A couple of family performance cars are getting upgrades for 2025MY. The GR Corolla receives increased torque from it’s 3 cylinder motor and an optional automatic transmission. While the Cadillac CT5 lineup of midsize sport sedans receives a styling and technology update that culminates with a performance package on the top trim V Blackwing.