01.06.2026

Market Insights – 1/6/26

Wholesale Prices, Week Ending January 3rd, 2026

The Canadian used wholesale market saw a decline of -0.54% in pricing for the week. Car segments prices decreased by –0.56% while the Truck/SUV segments decreased by -0.52%. Full-Size Car saw an increase of +0.32. The largest declines in the Car segments were seen in Sub-Compact Car at -0.76% and Prestige Luxury Car with -0.69%. The largest declines in the Truck/SUV segments were Compact Van with -2.43% followed by Sub-Compact Luxury Crossover/SUV at -1.44%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.56% | -0.26% | -0.32% |

| Truck & SUV segments | -0.52% | -0.38% | -0.39% |

| Market | -0.54% | -0.32% | -0.35% |

Car Segments

- Last week values softened for cars, with the overall segment down 0.56% despite one pocket of modest strength.

- The largest depreciations were noted in Sub-Compact Car (-0.76%), Prestige Luxury Car (-0.69%), Premium Sporty Car (-0.67%), and Luxury Car (-0.66%).

- The smallest declines and any increases were led by Full-Size Car (+0.32%), Sporty Car (-0.28%), and Midsize Car (-0.38%).

Truck / SUV Segments

- Last week values softened for trucks, with the overall segment down 0.52% and broad declines across most crossover, van, and pickup categories.

- The largest depreciations were led by Compact Van (-2.43%), Sub-Compact Luxury Crossover (-1.44%), Minivan (-1.00%), and Sub-Compact Crossover (-0.74%).

- The smallest declines and any stability were seen in Full-Size Crossover/SUV (+0.00%), Full-Size Van (-0.15%), Small Pickup (-0.27%), and Compact Crossover/SUV (-0.35%).

Wholesale

The Canadian market’s downward trend continues, with a steeper decline in comparison to its prior week. Truck segment values shifted by 0.14%, bringing the total decline to –0.52%. Car segment values recorded a 0.30% adjustment, bringing the total decline to –0.56%. Just over 59% of market segments recorded an average value change exceeding ±$100. Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers supporting firm floor prices. Supply has stabilized and returned to regular levels; however, upstream channels continue to hold priority sale access to inventory. Buyer demand for high-quality vehicles at auctions on both sides of the border persists.

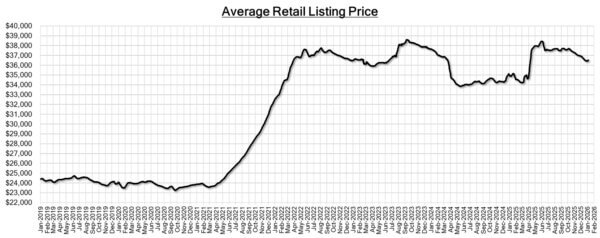

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $36,520. This analysis is based on approximately 206,460 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s GDP is estimated to have grown by 0.1% month-over-month in

November 2025, according to a flash estimate, partially offsetting the 0.3%

contraction recorded in October. - The S&P Global Canada Manufacturing PMI edged up to 48.6 in December 2025

from 48.4 in November, marking the eleventh straight month of contraction in

factory activity, though at the second-slowest pace during this period. - Manufacturing sales in Canada are estimated to have fallen by 1.1% in November

2025, following a 1% decline in October, according to preliminary estimates. The

largest decreases were reported in the transportation equipment and food

subsectors. - The yield on the Canadian 10-year government bond decreased to 3.42%.

- The Canadian dollar is around $0.727 this Monday morning, down slightly from

$0.730 a week prior.

U.S. Market

- The year closed with solid conversion rates and typical seasonal declines, accompanied by encouraging signs for a strong 2026 as large independents remained active in both bidding and purchasing.

Industry News

- BYD is the highest volume EV car maker globally for the first time, following a 2nd consecutive annual sales decline for Tesla. As EV sales increased 28% globally, BYD reaped benefits from sales growth in Europe while Tesla’s reputation was marred by CEO Elon Musk’s political representation, affecting overall sales.

- As Porsche CEO Oliver Blume ends his tenure to become CEO of VW Group this month, Michael Leiters joins from exotic car brand, McLaren to head up the German sports car maker. He will lead the company through a strategic transition, as the brand steps back its EV plans as that market has slowed down significantly amidst backlash from buyers. The shift has caused a 1.8B pound financial loss.

- The landscape for tariffs could be subject to change early in 2026, as the U.S. Supreme Court could rule on the legality of tariffs imposed by President Donald Trump. Also up for review is the current Canada, U.S., Mexico Agreement (CUSMA ), which Trump has threatened to abandon.

- The Ram brand brought back the Hemi V8 to its 1500 lineup late last year, and along with it will now revive the TRX trim which will now be badged as an SRT TRX with power going increasing from 702hp to 777hp, surpassing its immediate competitor, the Ford F-150 Raptor R.

- For 2026, VW has discontinued the I.D. Buzz electric van for North America, as slow sales impacted the excitement behind the model that brought 1970’s “VW bus” nostalgia back through an electric platform.

- One of Canada’s oldest racetracks has changed hands as Canadian Tire Motorsport Park (CTMP) will be owned by Peter Thompson, Co-Chairman of the Woodbridge Group, Chris Pfaff, CEO of Pfaff Automotive Partners, and investor Alek Krstajic. They take over from previous owners, Carlo Fidani and partners Ron and Lynda Fellows.